Table of Contents

Introduction

Financial markets are the engine room of the global economy, quietly powering everything from everyday business operations to long-term wealth creation, while offering traders and investors countless opportunities to participate in price movement across a wide range of assets. Whether you are placing your first trade from a home computer or aspiring to build a professional trading career, understanding how financial markets work is not optional—it is foundational.

For many new traders, financial markets appear overwhelming at first glance. Terms such as stocks, forex, commodities, bonds, and cryptocurrencies are often presented as separate worlds, each with its own rules, jargon, and risks. This confusion causes many beginners to jump from one market to another without fully understanding how any of them truly function. The result is often emotional decision-making, inconsistent results, and unnecessary losses.

The reality is far simpler and far more structured. All financial markets exist to facilitate the exchange of value, manage risk, and allow capital to flow efficiently between participants. Once you understand this shared purpose, the individual markets begin to make sense, and their interactions become logical rather than intimidating.

This comprehensive guide is designed to give new traders a clear, structured, and enjoyable introduction to financial markets, explaining how stocks, forex, commodities, and cryptocurrencies work, who participates in them, how they influence one another, and how you can begin navigating them with confidence rather than confusion.

What Are Financial Markets?

At their core, financial markets are organized environments where buyers and sellers exchange financial instruments such as stocks, currencies, commodities, bonds, and derivatives. These markets exist to connect those who have capital with those who need it, allowing businesses to grow, governments to function, and individuals to invest and manage risk.

Rather than being abstract concepts, financial markets perform very practical functions that affect everyday life, from mortgage interest rates and fuel prices to pension funds and savings accounts.

The Two Main Types of Financial Markets

| Market Type | Description | Example |

|---|---|---|

| Primary Market | Where new securities are created and sold for the first time | IPOs, new bond issuance |

| Secondary Market | Where existing securities are traded between investors | Stock exchanges, forex trading |

Financial markets play several essential roles simultaneously, including price discovery, which helps determine fair market value, liquidity provision, which allows assets to be bought or sold efficiently, capital allocation, which directs funds toward productive uses, and risk transfer, which enables hedging and speculation through derivatives.

Major Types of Financial Markets Explained

Stock Markets: Owning a Piece of a Business

The stock market allows individuals and institutions to buy and sell ownership stakes in publicly traded companies. When you purchase a stock, you are buying equity, meaning you own a small portion of that company and may benefit from its growth, profitability, and future success.

Stocks are traded on regulated exchanges such as the New York Stock Exchange (NYSE), NASDAQ, and London Stock Exchange (LSE), where prices fluctuate based on supply, demand, earnings expectations, and broader economic conditions.

Key Features of Stock Markets

| Feature | Explanation |

|---|---|

| Dividends | Regular payments made from company profits |

| Capital Gains | Profit from selling shares at a higher price |

| Volatility | Price fluctuations driven by news and sentiment |

| Regulation | Strong oversight to protect investors |

Stock prices are influenced by corporate earnings reports, interest rates, economic growth, geopolitical developments, and investor psychology. For beginners, stocks are often appealing because companies are familiar brands, making it easier to understand what you are investing in.

Forex Market: Trading Global Currencies

The foreign exchange market, commonly known as forex, is the largest and most liquid financial market in the world, with trillions of dollars traded daily. Unlike stocks, forex trading does not involve ownership; instead, traders speculate on the relative value of one currency against another.

Forex operates 24 hours a day, five days a week, due to overlapping global trading sessions in Asia, Europe, and North America, making it attractive to traders seeking flexibility.

Forex Market Basics

| Concept | Meaning |

|---|---|

| Currency Pair | Two currencies traded against each other |

| Pip | Smallest price movement unit |

| Leverage | Borrowed capital to increase position size |

| Spread | Difference between buy and sell price |

Central banks, commercial banks, hedge funds, corporations, and retail traders all participate in the forex market, each for different reasons ranging from monetary policy and international trade to speculation.

Commodity Markets: Trading Raw Materials

Commodity markets facilitate the trading of physical goods that are essential to the global economy, such as oil, gold, natural gas, and agricultural products. These markets allow producers and consumers to manage price risk while providing traders with opportunities to speculate on supply and demand imbalances.

Commodities are broadly divided into hard commodities, such as metals and energy, and soft commodities, such as grains and livestock.

Commodity Market Overview

| Commodity Type | Examples | Influencing Factors |

|---|---|---|

| Metals | Gold, Silver | Inflation, safe-haven demand |

| Energy | Oil, Gas | Geopolitics, supply shocks |

| Agriculture | Corn, Coffee | Weather, seasonal cycles |

Most retail traders access commodities through futures contracts, ETFs, or CFDs, avoiding physical delivery.

Cryptocurrency Markets: Digital Assets and Blockchain

Cryptocurrencies represent a modern evolution in financial markets, built on decentralized blockchain technology rather than centralized institutions. Assets like Bitcoin and Ethereum trade 24/7 on global exchanges, offering unmatched accessibility and volatility.

While crypto markets share similarities with traditional markets, they are uniquely influenced by technology upgrades, regulatory announcements, adoption rates, and market sentiment cycles.

How Financial Markets Are Connected

Financial markets do not operate in isolation. Movements in one market often create ripple effects across others, and understanding these relationships gives traders a significant analytical advantage.

Market Correlation Table

| Market Relationship | Typical Impact |

|---|---|

| USD vs Commodities | Strong USD often pressures commodity prices |

| Bonds vs Stocks | Rising yields often hurt growth stocks |

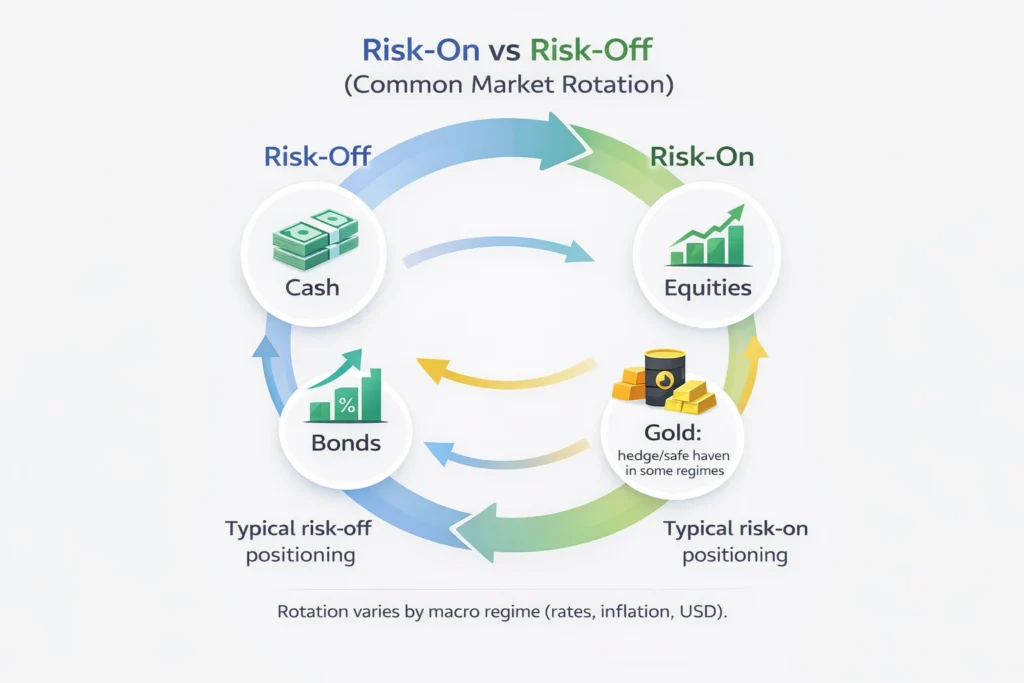

| Stocks vs Crypto | Risk-on periods boost both markets |

| Forex vs Equities | Currency strength impacts multinational profits |

Who Participates in Financial Markets?

| Participant | Role |

|---|---|

| Retail Traders | Individual traders using online platforms |

| Institutional Investors | Large funds managing billions |

| Central Banks | Control monetary policy |

| Market Makers | Provide liquidity |

| Corporations | Hedge risk and raise capital |

Understanding these participants helps traders anticipate liquidity behavior and volatility.

Common Financial Instruments for Beginners

| Instrument | Risk Level | Beginner Friendly |

|---|---|---|

| Stocks | Medium | Yes |

| ETFs | Low–Medium | Yes |

| Bonds | Low | Yes |

| Options | High | No |

| Futures | High | No |

| CFDs | High | Caution |

Diagram-Based Concept Explanation

Learning Resources and Strategic Next Steps

To deepen your understanding of how market knowledge translates into actionable trading decisions, it is essential to study how structure, planning, and execution come together within a disciplined framework. A highly recommended next step is our detailed guide on market structure, BOS, and CHOCH, which explains how professional traders read price action to identify high-probability setups. For broader foundational context, you can also explore the general overview of financial markets on Wikipedia, a stable and widely trusted educational resource. Combining internal strategy-focused education with external foundational references will significantly strengthen your trading knowledge.

Frequently Asked Questions (FAQ)

What is the best financial market for beginners?

Stocks and ETFs are generally considered the best starting point due to lower leverage and clearer fundamentals.

Is forex riskier than stocks?

Forex can be riskier due to leverage, but proper risk management makes it manageable.

Can I trade multiple markets at once?

Yes, but beginners should master one market before expanding.

How much money do I need to start trading?

Many platforms allow accounts with as little as $100, but education matters more than capital size.

Choosing the Right Financial Market as a Beginner

One of the most common mistakes new traders make is trying to trade every financial market at once. Stocks, forex, commodities, and cryptocurrencies each behave differently, attract different participants, and require different levels of capital, time commitment, and emotional control. Understanding which market best suits your personality and lifestyle can dramatically improve your chances of long-term success.

For beginners who prefer stability, transparency, and well-regulated environments, the stock market is often the most approachable starting point. Stocks move at a slower pace compared to forex or crypto, and there is an abundance of publicly available data such as earnings reports, financial statements, and analyst coverage. Long-term investors and swing traders often find equities easier to understand and less emotionally demanding.

The forex market is ideal for traders who enjoy macroeconomic analysis and flexible trading hours. Because forex operates 24 hours a day during the trading week, it allows part-time traders to participate without being tied to one session. However, leverage in forex can magnify losses just as quickly as gains, making risk management essential for beginners.

Commodity markets attract traders interested in global supply and demand dynamics, inflation, and geopolitical events. Markets like gold and crude oil are highly sensitive to macro news, making them excellent learning tools for understanding how economic events impact price. Commodities are best suited for traders who enjoy news-driven analysis and longer-term positioning.

Cryptocurrency markets, while exciting, are typically the most volatile and emotionally challenging. Crypto trades 24/7, reacts strongly to sentiment, and can experience extreme price swings in short periods. Beginners should approach crypto cautiously, start with small position sizes, and focus on education before aggressive trading.

The key is not choosing the “best” market, but choosing the right market for you. Start with one market, master its structure and behavior, and expand only after building consistency.

📊 OPTIONAL SMALL TABLE (Boosts SEO + UX)

You can also add this short table under that section for extra clarity and SEO strength:

| Market | Best For Beginners Who… | Risk Level |

|---|---|---|

| Stocks | Prefer stability and regulation | Medium |

| Forex | Like macro analysis and flexibility | Medium–High |

| Commodities | Enjoy news-driven markets | Medium |

| Crypto | Can handle high volatility | High |

Final Thoughts: Building a Strong Market Foundation

Understanding financial markets is the first real step toward becoming a confident and disciplined trader. Once you grasp how stocks, forex, commodities, and cryptocurrencies function individually and interact collectively, the financial world stops feeling chaotic and starts feeling structured. This knowledge empowers you to choose the right market, apply appropriate strategies, manage risk intelligently, and continue learning with purpose rather than confusion.

By combining market education, structure awareness, and disciplined planning, you transform trading from speculation into a professional skillset that can grow over time.

1 thought on “📘 Introduction to Financial Markets: How Stocks, Forex, Commodities, and Cryptocurrencies Work for New Traders (2026 Beginner’s Guide)”