Table of Contents

Introduction: Why Keeping Profits Is Harder Than Making Them

Most traders believe their primary challenge is learning how to enter trades correctly. They spend years studying charts, indicators, patterns, strategies, and setups in an effort to develop consistency. Eventually, many succeed. They begin to experience profitable days, account growth, and moments where everything finally seems to “click.” Yet this is where one of the most destructive paradoxes in trading reveals itself: success often triggers the very behaviors that undo it.

The majority of profit givebacks do not occur because the market suddenly changes or because a strategy stops working. They occur because the trader’s internal state changes. Making money and protecting money activate entirely different psychological systems, and most traders are never trained to recognize that shift. The emotional skills required to execute a trade are not the same skills required to sit with unrealized profit, tolerate uncertainty, and exit without tension.

This article explores why profit protection feels so psychologically unstable, why traders often sabotage themselves after success, and how long-term consistency is less about intelligence or discipline and more about emotional containment and identity alignment.

The Profit Protection Paradox

When traders are trying to make money, they are often focused, motivated, and process-oriented. They analyze structure, wait for conditions, and execute with clarity. However, once a trade moves significantly in their favor or a green day develops, something subtle but powerful shifts. Attention narrows. Emotional arousal increases. Outcomes begin to matter more than process.

This paradox is not a character flaw; it is a function of the human nervous system. The same trader, using the same strategy in the same market, can experience radically different emotions depending on whether they are seeking opportunity or defending results. Profit protection introduces psychological pressure that execution alone does not.

Why Profits Feel Unsafe to the Brain

From a neurological perspective, unrealized profit is perceived as unstable and temporary. The brain does not register it as owned or secure; instead, it treats it as something that can be taken away. Loss — or even the threat of loss — is processed more intensely than gain due to evolutionary survival wiring. This creates an internal conflict in winning trades, where multiple emotional impulses compete simultaneously.

One part of the trader wants to let the trade work, another wants certainty, another wants more, and another fears giving anything back. Without a strong psychological framework, fear usually wins because it promises immediate emotional relief. This explains why traders exit too early, hold too long, or oscillate between both behaviors even when they “know better.”

Why Traders Give Profits Back (Even When They Know Better)

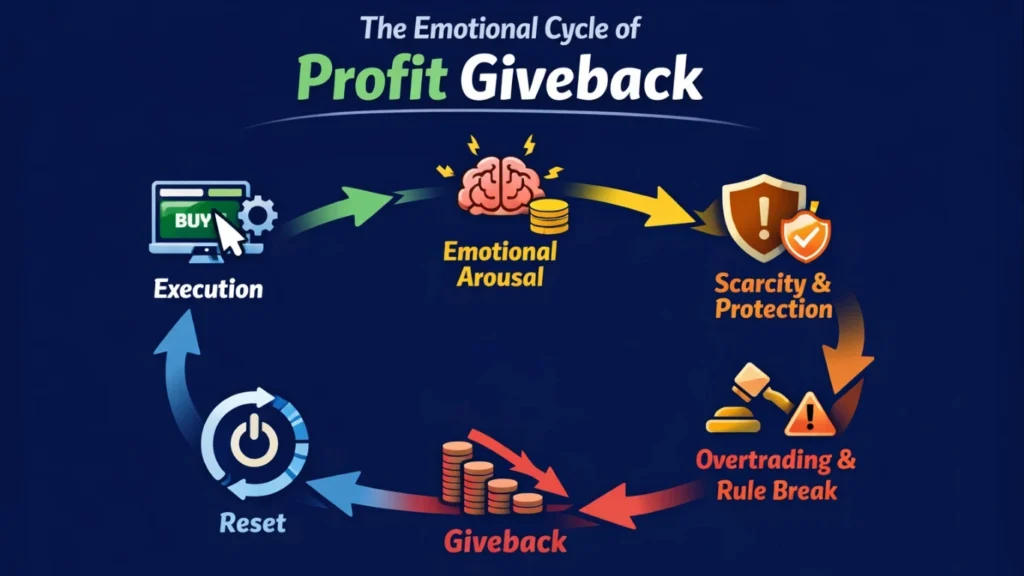

Profit giveback is rarely caused by recklessness or ignorance. Instead, it is driven by deeper psychological mechanisms that surface only after success. Profits activate identity pressure, scarcity thinking, emotional attachment, and unresolved beliefs about money and self-worth.

For some traders, profits feel undeserved, creating subconscious pressure to return to familiar ground. For others, profits increase expectations and performance anxiety. For many, profits trigger fear of falling back to past struggles. As a result, traders often overtrade, break rules, or force setups in an attempt to secure or validate success. Ironically, the moment they succeed is when they become most vulnerable.

This Is Not About Greed — It Is About Safety

The idea that traders give profits back because of greed is incomplete and often misleading. In reality, most profit givebacks occur because the nervous system is overstimulated and seeking safety, not excitement. Protecting profits requires emotional containment, restraint, and acceptance — skills that are rarely trained explicitly.

Where greed seeks more, fear seeks relief. Both can destroy structure. Profit protection is about learning to remain neutral in moments where the brain is wired to react.

Why the Brain Treats Profits Differently Than Losses

Psychologically, profits are abstract until realized, while losses are immediate and concrete. This imbalance makes loss avoidance feel urgent and profit protection feel ambiguous. The brain evolved to survive uncertainty, not optimize upside, so when a trade moves in your favor, the nervous system subtly enters an alert state.

This explains why traders often sabotage winning trades. The discomfort of potential loss outweighs the satisfaction of potential gain. Understanding this is critical, because it reframes profit protection as a neurological challenge rather than a discipline problem.

The Emotional Shift That Happens After You Win

Winning alters a trader’s internal state. Before a win, attention is directed toward execution and problem-solving. After a win, attention shifts toward outcome awareness and self-evaluation. Traders stop asking whether a setup is valid and start asking how to avoid losing what they made.

This protection-oriented mindset narrows perception and reduces decision quality. It is why many green days end poorly and why traders often take their worst trades after their best ones.

Scarcity Thinking and the Fear of Giving It Back

Scarcity thinking is one of the most common drivers of profit giveback. It manifests as thoughts like “What if this doesn’t happen again?” or “I need to make the most of today.” Scarcity is not about money; it is about memory. Traders who have experienced long drawdowns or inconsistency carry that instability in their nervous system.

When success finally appears, the body reacts as if it is fragile. This urgency destroys structure, and structure is what created the profit in the first place.

Why “One More Trade” Is the Most Dangerous Thought on a Green Day

Nearly every major profit giveback begins with the same internal sentence: “One more trade.” This thought signals a shift from execution to outcome management. Standards drop, attention narrows, and emotional immunity fades. Losses feel heavier because they threaten an already earned result.

Green days do not fail because of greed; they fail because structure is replaced by expectation.

Profitable Traders vs Durable Traders

Many traders can make money. Very few can keep making money. The difference lies in durability, not intelligence or strategy.

| Profitable Traders | Durable Traders |

|---|---|

| Focus on wins | Focus on protection |

| Measure daily results | Measure behavioral consistency |

| Emotionally reactive | Emotionally neutral |

| Maximize today | Preserve tomorrow |

Durable traders understand that the goal is not to win today but to still be trading months from now. They stop trading when clarity drops and reduce exposure after strong sessions.

Profit Protection Is an Identity Shift, Not a Rule Set

Mechanical tools like trailing stops and daily caps help, but they fail when identity lags behind results. If a trader still sees themselves as “trying to be consistent” or “proving they can do this,” profits feel temporary and are treated recklessly.

When identity aligns with consistency, profit protection becomes natural rather than forced.

How Professionals Separate Money From Performance

Professional traders develop the ability to decouple money from self-worth and outcomes from competence. A green day does not define them, and a red day does not invalidate them. Money becomes feedback, not validation. This emotional separation allows them to protect profits calmly and consistently.

Redefining Consistency

Consistency is not making money regularly; it is repeating correct behavior under changing emotional conditions. Profit protection is proven on winning days, not losing ones. The hardest skill in trading is letting money exist without reacting to it.

Related Resources and Further Learning

Many traders struggle with profit protection because they misinterpret short-term market behavior as meaningful change and underestimate the psychological pressure that comes with success. Understanding how failed momentum distorts decision-making, how emotional reactions to open profits lead to rule-breaking, and how behavioral biases shape trading outcomes is essential for long-term consistency. Together, these concepts explain why traders often assume opportunity when risk is actually increasing and why profits are frequently given back despite sound strategies.

Frequently Asked Questions (FAQ)

Why do traders give profits back so often?

Because winning activates emotional pressure, not relief. Once in profit, the brain shifts into protection mode, increasing reactivity and reducing objectivity.

Is profit giveback caused by greed?

Usually not. Most givebacks are driven by fear, identity pressure, and scarcity thinking rather than a desire for more money.

Why does protecting profits feel harder than entering trades?

Because profit protection requires restraint and emotional containment, while execution feels active and purposeful.

Why do traders overtrade on green days?

Green days increase emotional arousal and expectations, lowering standards and increasing urgency.

Is profit protection technical or psychological?

Primarily psychological. Technical tools fail if emotional regulation and identity alignment are weak.

Conclusion: Why Protecting Profits Is the Skill That Determines Your Future as a Trader

In trading, it is easy to believe that profitability is the finish line — that once you learn how to make money, the hardest part is behind you. In reality, consistent profitability is not a destination; it is a psychological threshold. Crossing it exposes weaknesses that were invisible during struggle. This is why so many traders experience their most painful setbacks after they begin to succeed. The market does not take their profits away — their own nervous system does.

Protecting profits is difficult because it demands a level of emotional maturity that most trading education never addresses. Execution rewards decisiveness, confidence, and engagement, but profit protection demands restraint, neutrality, and patience. It requires the ability to sit with uncertainty without acting, to tolerate open profit without rushing to secure it, and to accept fluctuation without interpreting it as threat. These are not tactical skills; they are psychological capacities.

What makes profit protection uniquely challenging is that it forces traders to confront identity. A winning trade or green day does not just represent money — it represents progress, hope, validation, and escape from past failure. When those meanings are unconscious, they turn profits into emotional pressure. The trader is no longer managing a position; they are defending a version of themselves. That is when structure collapses, rules are bent, and discipline quietly disappears.

Durable traders learn to remove meaning from money. They understand that profits are not something to guard emotionally, but something to allow structurally. They do not chase green days, defend outcomes, or measure their worth by results. Instead, they anchor their confidence to behavior — to whether they respected conditions, followed process, and exited when clarity faded. This behavioral orientation is what allows them to stop trading on strong days, reduce exposure after success, and walk away without fear of missing out.

True consistency is not proven during losing streaks; it is proven during winning ones. Anyone can follow rules when the account is under pressure. Very few can remain disciplined when everything is going well. That is why profit protection is the real edge. It is the skill that keeps you in the game long enough for your strategy to compound. It is what transforms profitability from a temporary phase into a durable state.

If you have been giving profits back, this is not a failure. It is evidence that your trading has reached a new psychological layer. The discomfort you feel around success is not something to eliminate — it is something to understand, regulate, and outgrow. Once you learn to let profits exist without reacting to them, trading stops feeling like a constant battle. It becomes quieter, steadier, and far more sustainable.

And that is where real consistency begins.

📝 Note for Traders

This article is not about where to place a stop-loss, how many points to trail, or which exit strategy is “best.” It is about something far more important — and far more dangerous: why traders who know how to make money often fail to keep it. If you have ever watched solid profits turn into breakeven, given back days or weeks of gains in a single session, felt uneasy when a trade was going too well, or noticed that you trade worse after winning than after losing, this article is written for you.

We will not start with tactics. We will start with psychology, identity, and money behavior — because until those are understood, no exit rule will ever truly protect your profits.