Table of Contents

Introduction: The Habit That Sabotages Good Traders Without Them Noticing

Most traders don’t lose money because their strategy is bad. They lose because their behavior changes while the trade is still open — often for a reason so small it feels harmless. One glance at an updating profit-and-loss number is enough to turn a disciplined plan into an emotional reaction, even for traders who genuinely know better.

Watching profit and loss feels responsible. It feels like risk management. It feels like staying aware. But in reality, it quietly shifts your attention away from price and into emotion, where fear, relief, and hope start influencing decisions that were supposed to be mechanical. This is why traders who look consistent on paper suddenly become inconsistent in live markets.

If you’ve ever exited a winning trade too early “just to lock something in,” held a losing trade longer than planned because it was “almost back,” or felt stressed even though nothing had actually changed in market structure, profit and loss was likely the trigger. The issue is not that P&L exists — it’s when you interact with it and how it interferes with decision-making.

This article is written to expose a mistake most traders never realize they’re making. You’ll learn why watching profit and loss during live trades undermines discipline, how it causes both early exits and late stops, and why professional traders deliberately separate execution from outcome. By the end, you’ll understand how removing profit and loss from the execution window can immediately improve consistency, clarity, and emotional control.

Why Most Traders Misunderstand the Role of P&L

One of the biggest misconceptions in trading is believing that profit and loss is a useful decision-making tool during a trade. Traders are taught to manage risk, monitor exposure, and protect capital, so it feels logical to keep an eye on profits and losses in real time. The problem is that profit and loss does not reflect market structure, trade validity, or edge — it reflects emotional impact.

P&L shows how a trade feels, not whether it is right. It responds instantly to every tick, even when price is doing nothing meaningful. This creates a false sense of urgency and significance around normal fluctuations. A small pullback becomes threatening, a pause becomes uncomfortable, and a temporary profit feels fragile. None of these reactions are based on analysis — they are based on perception.

This misunderstanding leads traders to believe they are “managing” trades, when in reality they are reacting to emotional signals generated by numbers on a screen. Over time, this erodes discipline and creates execution patterns that have nothing to do with the strategy itself.

How Watching profit and loss Shifts Focus From Process to Outcome

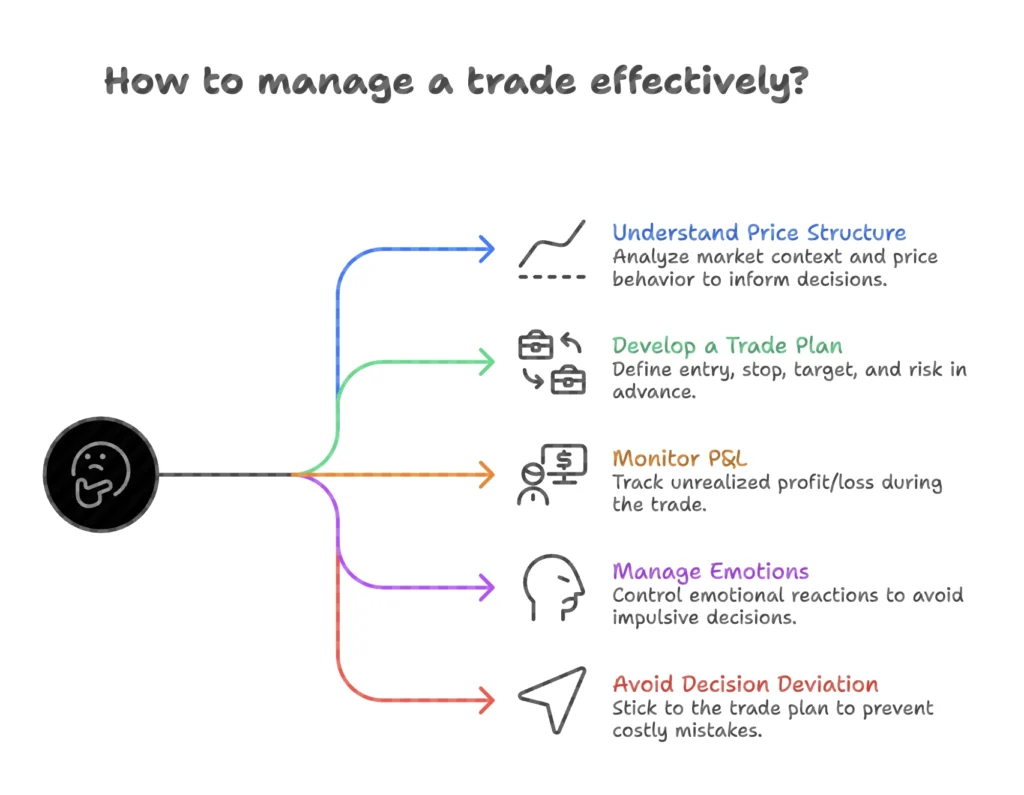

Strong trading decisions are made before a trade is entered. Entry logic, invalidation, risk limits, and exit conditions should already be defined. Once a trade is live, the job is simple: monitor price behavior and act only if the market invalidates the original thesis. profit and loss does not belong in that process.

The moment a trader starts watching profit and loss, attention shifts away from process and toward outcome. Instead of asking whether structure is intact or whether price has reached a meaningful level, the mind starts asking emotionally loaded questions: What if this profit disappears? What if this turns into a loss? Should I close now just in case?

This shift is subtle but destructive. Outcome-focused thinking is reactive by nature. It encourages decision-making based on fear and relief rather than logic. Two identical setups may be managed completely differently simply because profit and loss behaved differently early in the trade. The strategy hasn’t changed — the trader’s focus has.

Professional traders are keenly aware of this trap. That is why they prioritize execution quality over moment-to-moment results and review performance only after trades are closed.

The Psychological Mechanism Behind profit and loss Obsession

P&L interacts directly with basic human psychology. When a trade shows unrealized profit, the brain treats it as something already owned. Any pullback then feels like a loss, triggering loss aversion — one of the strongest behavioral biases in decision-making. The urge to “protect” the number becomes stronger than the commitment to follow the plan.

When profit and loss is negative, the opposite happens. The discomfort of seeing a loss activates avoidance behavior. The mind searches for reasons to delay acceptance, creating narratives like “it will come back” or “this is just noise.” Instead of managing risk, the trader starts negotiating with the trade.

This emotional feedback loop happens even when rules are clear. Many traders later say, “I knew what I was supposed to do, but I didn’t do it.” That disconnect exists because emotional signals overpower rational intent in real time. profit and loss amplifies those signals precisely when clarity is most needed.

Why P&L Causes Early Profit-Taking

One of the most common performance problems in trading is not losing trades — it is cutting winning trades short. Watching unrealized profit creates a false sense of urgency. The moment a trade turns green, the focus shifts from execution to preservation. Normal pullbacks feel dangerous, even when they are part of healthy price movement.

As a result, traders exit based on fear rather than structure. They take small wins to avoid emotional discomfort, only to watch price continue in their original direction. Over time, this leads to poor risk-to-reward profiles and the frustrating feeling of being “right but not profitable.”

When traders stop watching P&L, patience improves almost immediately. Pullbacks are seen as price behavior rather than threats. Trades are allowed to develop according to plan, and risk-to-reward improves naturally without forcing discipline.

Why P&L Encourages Holding Losing Trades Too Long

P&L doesn’t just cut winners short — it also encourages traders to hold losers beyond their intended limits. When losses remain unrealized, the mind perceives an opportunity to escape discomfort. Closing the trade would make the loss real, and that psychological resistance often overrides predefined stops.

This is how small, planned losses turn into large, unplanned ones. Decision-making shifts from objective criteria like invalidation and structure to emotional bargaining. At that point, discipline has already been replaced by hope.

Professional traders do not wait for losses to “feel better.” They accept losses as part of execution. If the market invalidates the setup, they exit — regardless of how uncomfortable the number looks.

How P&L Creates Inconsistent Execution

One of the most confusing experiences for traders is feeling that a strategy makes sense, yet results remain inconsistent. In many cases, the strategy is not the problem. Execution variability is.

When P&L is constantly visible, every trade feels different emotionally, even when setups are identical. One trade feels safe because it goes green quickly. Another feels wrong because it starts red. Another feels stressful because it hovers near breakeven. These emotional differences lead to inconsistent management decisions.

Backtesting often looks clean because P&L does not feel real in replay. Live trading feels chaotic because emotional feedback is immediate. Removing P&L from the execution window eliminates this variable, allowing execution to stabilize.

How P&L Interferes With Trade Execution

Why P&L Visibility Breaks Execution Discipline

When traders focus on profit and loss during an active trade, decision-making quietly shifts away from price behavior and toward emotional response. This is one of the most common reasons traders struggle with consistency, even when their strategy is sound. We break this psychological pattern down further in Trading Consistency: The Silent Killers, where emotional triggers like P&L fixation are shown to be just as destructive as poor risk management.

The same execution breakdown also explains why traders struggle to protect open profits under pressure, a problem explored in Profit Protection and Trading Psychology. For a neutral, educational explanation of how profit, loss, and decision-making interact in real trading environments, Investopedia provides a clear breakdown of behavioral finance concepts that influence trader psychology.

How Professional Traders Separate Execution From Results

Professional traders do not ignore results — they review them at the correct time. During live trades, their focus remains on price behavior and predefined rules. P&L becomes relevant only after the trade is closed, during journaling and performance analysis.

Many professionals deliberately hide or minimize P&L displays, reduce unnecessary indicators, and predefine exits before entering trades. This environment design removes temptation rather than relying on willpower. Once risk is accepted upfront, there is no emotional negotiation during the trade.

This separation allows traders to remain calm during drawdowns, patient during pullbacks, and disciplined regardless of short-term outcomes.

Common Mistakes Traders Make With P&L

| Mistake | Consequence |

|---|---|

| Watching P&L tick-by-tick | Emotional overreaction |

| Managing trades by money instead of price | Inconsistent exits |

| Taking profits early to feel safe | Poor risk-to-reward |

| Holding losers to avoid loss | Large drawdowns |

| Reviewing results mid-trade | Loss of discipline |

Practical Ways to Stop P&L From Controlling Decisions

The solution is not stronger discipline — it is better structure. Hiding or minimizing P&L during trades, managing positions by price levels rather than money, reducing position size when emotions feel intense, and reviewing results only after trades close are practical steps that immediately improve execution quality.

Journaling decisions instead of outcomes reinforces process-based thinking. Asking whether structure has changed before reacting to P&L retrains attention back to price, where it belongs.

P&L, Risk, and Capital Protection (Internal + External Context)

Understanding how emotional decision-making interacts with exposure is critical, especially when traders increase size or trade funded accounts. Many execution errors triggered by P&L become far more damaging when leverage and position sizing amplify mistakes, which is why these behaviors are closely linked to the leverage mistakes that wipe out traders and the broader topic of profit protection and trading psychology on Mastery Trader Academy.

For a neutral, foundational explanation of how profit-and-loss, risk, and exposure interact in regulated markets, Investopedia’s guide to trading psychology and risk management remains one of the clearest public educational resources available and complements the practical insights discussed here.

Frequently Asked Questions About Watching P&L

Is watching P&L always bad?

No. P&L is useful for review and performance analysis after trades close. The problem is watching it during execution.

Why does P&L feel so emotionally powerful?

Because it triggers loss aversion and reward anticipation, which are deeply wired psychological responses.

Should beginners hide P&L completely?

Many beginners benefit from minimizing it during trades, especially while developing discipline and consistency.

Does position size affect P&L obsession?

Yes. Oversized positions intensify emotional reactions. Reducing size often reduces the urge to watch P&L.

How do professionals review P&L safely?

After trades close, during journaling and statistical analysis — not while decisions are being made.

Final Thoughts: Discipline Improves When P&L Leaves the Execution Window

P&L is information, not guidance. When watched during trades, it transforms trading into an emotional experience rather than a structured process. It pulls attention away from price behavior and replaces logic with fear, relief, and hope. Over time, this erodes consistency even when the strategy itself is sound.

Traders who improve are not emotionless — they simply design their environment to reduce emotional interference. By separating execution from results and focusing on price rather than numbers, decision-making becomes calmer, clearer, and repeatable.

Trading improves when outcomes are reviewed after execution, not during it. That single shift is often enough to restore discipline, confidence, and long-term consistency.