Table of Contents

Introduction: The Thought That Ends More Trading Careers Than Losses

Most trading mistakes don’t start with recklessness, greed, or a lack of knowledge.

They start with a sentence that feels harmless, rational, and even responsible:

“Just one more trade.”

It sounds controlled. It sounds calm. It sounds like a disciplined trader squeezing value from a still-active session. And that is exactly why it is so dangerous. This thought rarely feels emotional, impulsive, or reckless in the moment. It feels justified — almost professional.

But for many traders, this single sentence marks the precise moment when execution quality begins to collapse.

Not because the market changed.

Not because opportunity disappeared.

But because the trader’s internal state quietly shifted.

This article is written to expose that shift clearly and honestly. You will learn why “just one more trade” is not a decision at all, but a psychological response disguised as logic — and why recognizing it early can save you from some of the most unnecessary and expensive mistakes in your trading journey.

Why “Just One More Trade” Is So Deceptive

“Just one more trade” is rarely about market conditions. It is almost always about internal regulation.

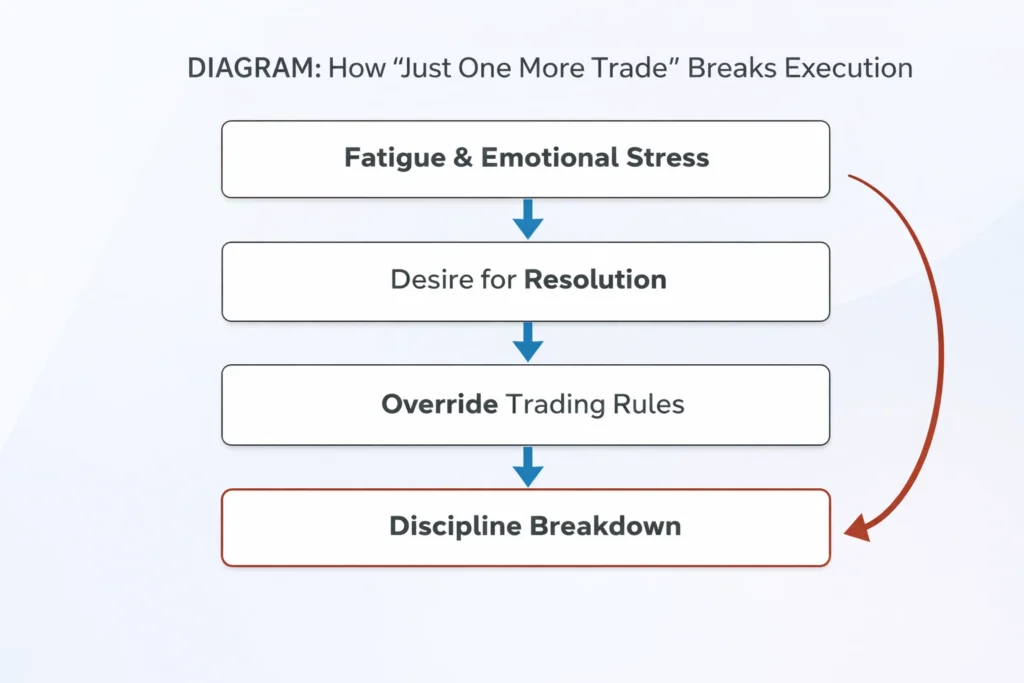

By the time this thought appears, the trader is no longer responding to structure, probability, or edge. They are responding to fatigue, emotional arousal, or discomfort with uncertainty. The language sounds reasonable, but the motivation has shifted. The trade is no longer being taken because conditions are optimal. It is being taken because the trader wants something to end, resolve, or feel complete.

This is what makes the trap so effective. There is no obvious emotional spike. No panic. No urgency. Just a quiet sense that one more action will settle the session. Unfortunately, markets do not provide emotional closure. They only provide more outcomes — often random ones.

And when a trader uses the market to regulate internal state, discipline is already compromised.

When Session Fatigue Turns Good Decisions Into Impulses

One of the most misunderstood forces in trading psychology is session fatigue. This is not physical tiredness. Many traders feel alert, engaged, and focused when fatigue is already affecting them. The danger lies in the subtle degradation of judgment — not in exhaustion.

Trading demands continuous cognitive control: evaluating uncertainty, regulating emotion, managing risk, and resisting impulses. Each decision draws from the same mental reservoir. As that reservoir depletes, the brain begins to favor speed over accuracy and relief over restraint.

This is why late-session trades often feel “reasonable” even when they violate the trader’s own standards. The trader doesn’t feel reckless. They feel confident — but that confidence is no longer supported by full cognitive control.

The thought “just one more trade” often appears precisely when this depletion has reached a tipping point.

Why Fatigue Doesn’t Announce Itself

Unlike physical fatigue, cognitive fatigue is silent. There is no clear signal telling you to stop. Instead, it manifests as subtle changes in behavior: impatience, faster decision-making, reduced tolerance for waiting, and an increased willingness to bend rules.

This is why traders frequently say, “I felt fine — I just made a bad decision.”

In reality, the decision was made with reduced mental bandwidth. The trader’s standards didn’t disappear; they became easier to negotiate with. And negotiation with rules is where discipline quietly dies.

“Just One More Trade” Is a Psychological Warning Sign

The phrase “just one more trade” is one of the most common warning signs that a trader’s decision-making has shifted from structured execution to emotional impulse. What makes just one more trade so dangerous is that it rarely feels reckless in the moment. It feels reasonable, controlled, and justified by recent outcomes. Traders tell themselves that just one more trade will confirm a good day, repair a small loss, or bring emotional closure to a session.

In reality, this mindset usually appears when fatigue has already set in and discipline is no longer operating at full strength. Over time, repeatedly acting on just one more trade conditions traders to ignore limits, override predefined rules, and associate consistency with activity rather than restraint. This is why professional traders learn to treat just one more trade not as an opportunity, but as a psychological stop signal.

The Emotional Needs Behind “Just One More Trade”

The surface behavior looks the same, but the emotional drivers underneath vary. Understanding them is critical, because once you can identify the need, the impulse loses its power.

After a Win: The Need for Confirmation

Following a successful trade or a green session, traders often feel an unspoken pressure to prove the result was not luck. One more trade promises validation. Unfortunately, confirmation trades are emotionally loaded. They are taken to support identity, not probability.

After a Loss: The Need for Repair

After a losing trade, “just one more” often carries urgency. The trader wants to fix the feeling of ending red. This is emotional repair, not execution. Repair trades compress time, reduce patience, and inflate risk.

During Quiet Sessions: The Need for Control

In low-activity periods, traders often feel unproductive. Action feels safer than waiting. The market becomes a way to feel involved — even when no edge exists.

In all cases, the trade is no longer about opportunity. It is about emotional completion.

Why the Market Is a Terrible Emotional Regulator

Markets do not respond to emotional needs. They do not provide closure, validation, or relief. They deliver outcomes around probability. Using the market to regulate internal state is one of the fastest ways to turn randomness into damage.

This is why unnecessary trades feel so painful in hindsight. The trader wasn’t chasing money. They were chasing resolution — and paid for it.

Discipline Is a Resource, Not a Personality Trait

Many traders believe discipline is something you either have or don’t. In reality, discipline is a finite cognitive resource. Every act of restraint consumes energy. Early in a session, discipline feels effortless. Later, it feels heavy.

When discipline depletes, it is replaced by rationalization. Rules don’t disappear; they are reinterpreted. The trader doesn’t think, “I’m breaking my rules.” They think, “This one still makes sense.”

This is why late-session mistakes are obvious only in hindsight.

Why Willpower Alone Fails

Trying to override depletion with willpower is unsustainable. Eventually, the brain chooses relief. This is why professional traders do not rely on discipline alone. They rely on structure.

They pre-define session length, risk limits, and stopping conditions before emotion enters the picture. They don’t wait until discipline fails. They assume it will — and remove the opportunity for failure.

The Illusion of Control That Makes Stopping So Hard

Extended screen time creates familiarity. Familiarity creates perceived control. Traders begin to feel connected to the market, as if presence itself generates edge. Stepping away feels irresponsible, even when nothing has changed structurally.

This illusion is powerful. Action feels like control. Stillness feels like surrender. But markets reward selectivity — not presence.

Stopping feels uncomfortable because it forces acceptance of uncertainty. But uncertainty is not danger. It is the normal state of markets.

How Professional Traders Know When a Session Is Over

Professionals don’t stop when they’re exhausted. They stop when clarity fades. They end sessions early — especially green ones — because emotional arousal increases risk after success.

They pre-decide stopping conditions when calm, not while emotionally engaged. There is no negotiation. No bargaining. No “just one more.”

They understand the difference between opportunity and capacity. The market may still offer setups, but the trader’s capacity to execute them well may be gone. Capacity matters more than opportunity.

What to Do Instead of Taking “Just One More Trade”

You don’t defeat this trap with resistance. You defeat it with redirection.

When the thought appears, translate it. Ask what the impulse is actually requesting: closure, relief, confirmation, or control. None of these are solved by another trade.

End the session decisively. Close the platform. Leave the space. Remove ambiguity. Ambiguity feeds temptation.

Redirect energy physically or mentally. Light movement, walking, journaling one observation — not to be productive, but to regulate state.

Redefine a good session. A good session is not one with maximum trades or perfect P&L. It is one where limits were respected and clarity preserved.

How “Just One More Trade” Breaks Execution

Common Mistakes Traders Make With Late-Session Trades

| Mistake | Why It Happens | Result |

|---|---|---|

| Trading past planned session | Fatigue masked as confidence | Rule violations |

| Taking confirmation trades | Identity seeking | Overconfidence losses |

| Repair trading after losses | Emotional repair | Escalating drawdowns |

| Staying “just to watch” | Illusion of control | Accidental trades |

Why Most Traders Misunderstand This Problem

Most traders believe overtrading is about greed or lack of discipline. In reality, it is about state mismanagement. They try to fix behavior without addressing energy, fatigue, and emotional regulation.

This is why rules alone fail. Without structure that respects human limits, rules become negotiable under pressure.

A Note on Risk, Psychology, and Capital Protection

Understanding how emotional state interacts with decision-making is a cornerstone of professional trading psychology. For a neutral, research-backed explanation of how risk exposure, fatigue, and decision quality interact in real trading environments, Investopedia’s overview of behavioral finance provides a clear and reliable external reference.

Internally, this concept connects directly with capital preservation and execution discipline principles discussed in Profit Protection and Trading Psychology, where we break down how professionals structure decisions to protect both equity and mental capital under pressure

Frequently Asked Questions

Why does “just one more trade” feel logical?

Because it is driven by emotional needs, not impulse. It feels calm, not reckless, which makes it harder to detect.

Is this problem only for beginners?

No. It often affects improving traders more because confidence masks fatigue.

Why do late-session trades perform worse?

Because cognitive control is depleted, even if the trader feels alert.

Should I stop trading when I feel tired?

Stop when clarity fades, not when exhaustion hits. Fatigue appears earlier than most traders realize.

How do professionals avoid this trap?

By pre-defining session limits, stopping conditions, and assuming discipline will weaken over time.

Final Thoughts: The Most Expensive Trades Are the Ones You Didn’t Need

The most damaging trades are rarely catastrophic losses. They are unnecessary trades taken when the session should already be over. Trades driven by emotional completion rather than edge.

“Just one more trade” is not ambition. It is not opportunity. It is a signal.

And learning to honor that signal — calmly, confidently, without negotiation — is one of the most profitable skills a trader can develop, even though it never appears on a chart.

The market will always be there.

Your mental capital will not — unless you protect it.