Table of Contents

Introduction: Why Most Traders Quit at the Wrong Moment

Most traders believe they will quit trading if they blow up an account, make a catastrophic mistake, or experience a dramatic failure.

In reality, very few traders quit during moments of chaos. They quit during silence.

They quit during long losing periods where nothing is obviously broken, but nothing seems to work either. Where discipline feels heavier every day. Where effort no longer produces feedback. Where confidence fades quietly rather than collapsing all at once.

This article is not about fixing your strategy, adding indicators, or finding a new edge. It is about surviving psychologically when trading stops rewarding you for doing the right things.

If you have ever followed your rules and still lost repeatedly, questioned your ability despite years of experience, or felt emotionally exhausted rather than angry or desperate, you are not alone. You are likely in the most misunderstood phase of a trader’s development.

This article will explain why long losing periods feel uniquely destructive, how they quietly distort behavior, and how professional traders survive them without forcing recovery or abandoning themselves in the process.

Why Long Losing Periods Feel So Different From Normal Losses

Every trader expects losses. Most traders are prepared for bad days or even bad weeks. Very few are prepared for months where results stagnate, drawdowns persist, and confidence erodes slowly rather than violently.

Short losing streaks are painful, but they are also contained. They feel temporary and actionable. Long losing periods are different. They create ambiguity rather than shock.

Over time, losses stop feeling like information and start feeling personal. Execution that once felt solid begins to feel pointless. The trader stops asking technical questions and starts asking existential ones: What am I missing? Why isn’t this working anymore? Am I actually good at this?

These questions are dangerous not because they are irrational, but because they shift attention away from process and toward identity.

The Silent Psychological Damage of Prolonged Drawdowns

Confidence does not collapse suddenly during long losing periods. It erodes incrementally.

Another losing week adds friction. Another quiet month drains belief. Watching other traders succeed while you stall amplifies self-doubt. Eventually, even correct decisions begin to feel meaningless.

This is how extended drawdowns do their real damage. Not by taking money, but by taking clarity.

When clarity disappears, traders stop trusting their own judgment. Risk management becomes defensive. Execution becomes hesitant. The trader is no longer managing probability; they are managing discomfort.

Why This Phase Breaks More Traders Than Any Blow-Up

Most traders do not quit after catastrophic failure. They quit here.

They quit during the slow grind where motivation fades, discipline feels forced, and rules begin to bend subtly rather than dramatically. Strategy hopping becomes tempting not because the trader is reckless, but because the mind seeks relief from prolonged uncertainty.

The pain is not loud enough to force change, but it is constant enough to wear you down. This is the phase where capable, intelligent traders disappear quietly.

What This Article Will Help You Understand

This article will not offer shortcuts or motivational reassurance. Instead, it will help you understand:

- Why the brain interprets extended drawdowns as personal threats

- How identity becomes entangled with performance over time

- The psychological traps traders fall into during prolonged underperformance

- Why discipline alone cannot carry you through this phase

- How professional traders think and behave when nothing seems to work

Surviving long losing periods is not about optimism. It is about stability. This phase does not test intelligence or effort. It tests psychological endurance.

Section 1: Why the Brain Treats Drawdowns as Threats

Long losing periods do not just hurt emotionally. They activate biological survival responses.

The human brain is not designed to tolerate prolonged uncertainty without resolution. In trading, a drawdown is not experienced as a neutral data point. It is experienced as a threat—not only to money, but to identity, safety, and self-trust.

When losses continue over time, the brain shifts out of analytical mode and into survival mode. Risk feels amplified. Time feels compressed. Patience feels dangerous. The trader may still believe they are thinking rationally, but internally the nervous system is on alert.

This is why small losses feel heavier, normal drawdowns feel catastrophic, and confidence collapses faster than expected. The brain is no longer asking whether a trade is valid. It is asking how to make the discomfort stop.

Why Emotional Pain Accumulates Over Time

One of the most confusing aspects of long losing periods is that they often get harder, not easier. The brain keeps score emotionally, not statistically.

Each loss reactivates previous frustration. Each drawdown confirms existing doubt. Over time, emotional weight accumulates. By the tenth or twentieth loss, the trader is reacting not to the current trade, but to the entire history of the drawdown.

This emotional accumulation explains why reactions become disproportionate. Overtrading increases. Hesitation appears. Rules begin to break. The trader is trying to escape a psychological state, not a market condition.

The Identity Threat Hidden Inside Extended Losing Periods

Extended drawdowns quietly threaten identity. Thoughts emerge that are rarely spoken aloud: Maybe my success was luck. Maybe I don’t belong here.

When identity feels threatened, objectivity disappears. Decision-making becomes defensive. The need to prove something intensifies. Trading stops being about execution and becomes about self-validation.

This is why even experienced traders struggle during prolonged underperformance. Knowledge does not protect against nervous system activation. Understanding probability does not calm fear when uncertainty persists too long.

Section 2: Psychological Traps Traders Fall Into During Extended Drawdowns

Once a losing period stretches beyond what feels reasonable, the mind looks for relief. Not strategic relief—psychological relief. This is where most damage occurs.

Trap 1: Personalizing the Drawdown

Losses are no longer seen as system variance but as personal failure. Language shifts internally from the strategy is underperforming to I am underperforming. Objectivity disappears.

Trap 2: Constant Adjustment

Stillness becomes unbearable, so traders tweak rules, change sizing, add filters, remove filters, and switch markets. Each change feels logical. None are given enough time to resolve.

Trap 3: Strategy Abandonment at the Worst Moment

Many traders abandon viable strategies just before variance turns. The psychological cost becomes too high, reinforcing a cycle of pain, quitting, and restarting elsewhere.

Trap 4: Fear-Based Discipline

Reduced size, early exits, and avoidance of valid setups feel responsible but are actually fear responses. Risk management becomes emotional management.

Trap 5: Quiet Withdrawal

Some traders shut down entirely. Journaling stops. Reviews stop. Engagement fades. Belief erodes quietly under the surface.

Key insight: Extended losing periods expose coping mechanisms. Most traders fail not because they lose money, but because they adopt behaviors that prevent recovery.

Section 3: Why Discipline Alone Is Not Enough

During long losing periods, traders are often told to “stay disciplined.” While well-intentioned, this advice is incomplete.

Discipline is a finite resource. It works in short bursts, but prolonged psychological strain exhausts it. Each disciplined action taken while losing costs more emotional energy than the last.

When discipline becomes the only tool, traders begin forcing behavior, suppressing emotion, and trading to prove resilience rather than to execute well.

Stability matters more than discipline. Stability reduces the need for constant self-control. Without it, discipline becomes brittle.

Professionals understand this. They reduce exposure, trade less, shorten sessions, and protect mental capital. This is not weakness. It is risk management applied to the trader.

Section 4: How Professional Traders Think During Prolonged Underperformance

Professionals are not emotionally unaffected by losing periods. They interpret them differently.

They do not ask what is wrong with them. They ask whether the phase is normal variance, whether the edge is dormant, and what remains within their control.

They expect drawdowns. This expectation alone reduces panic. They resist compulsive fixing and focus instead on execution integrity.

They shift attention from recovery to exposure management. The goal is not to win back losses. The goal is to remain intact until conditions improve.

Professionals trust time more than emotion. Emotional urgency is not treated as a signal. Recovery is allowed to occur quietly.

Section 5: What Actually Helps Traders Survive Long Losing Periods

Survival is not about becoming tougher. It is about becoming more protected.

Professionals shrink emotional surface area by trading less, checking results less often, and limiting exposure to noise. They separate outcome from identity and redefine what constitutes a successful day.

They allow doubt without acting on it. Doubt is treated as information, not instruction. Identity is diversified beyond trading to reduce existential pressure.

Key insight: Survival requires reducing emotional exposure while maintaining structure.

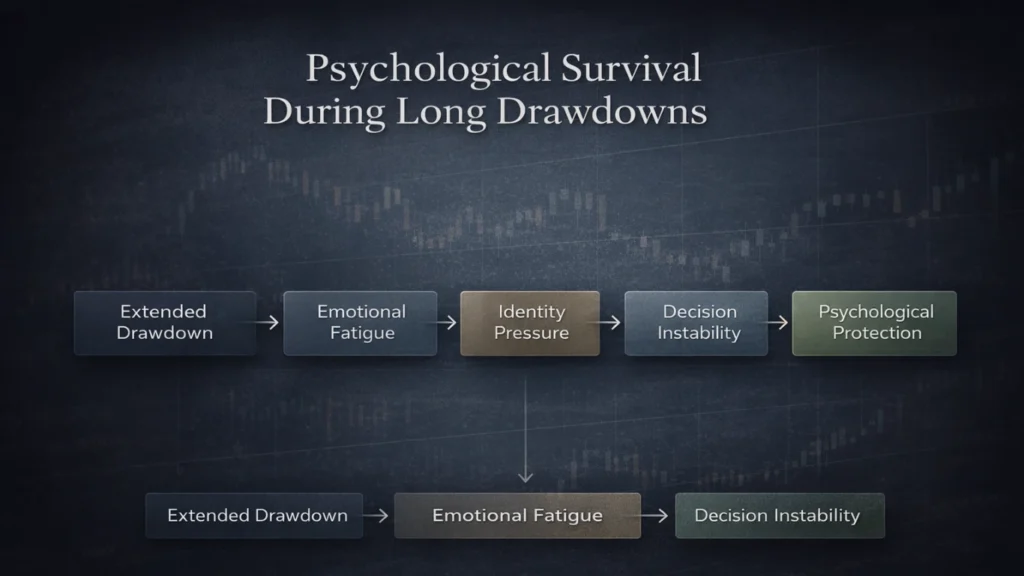

Psychological Survival During Long Drawdowns

A Note on Risk, Psychology, and Capital Protection

Understanding how prolonged stress alters decision-making is a cornerstone of professional trading psychology. Research in behavioral finance shows that loss aversion and emotional fatigue consistently distort judgment under uncertainty. A clear external explanation of these mechanisms can be found in Investopedia’s behavioral finance resources. Internally, this principle connects directly with execution discipline and capital protection frameworks discussed throughout our trading psychology resources, where emotional neutrality is treated as a risk management skill rather than a personality trait.

A Note on Risk, Psychology, and Capital Preservation

Extended drawdowns place sustained pressure on the nervous system, not just on trading capital, which is why psychological stability becomes a form of risk management rather than a personality trait. Research in psychology shows that prolonged uncertainty and repeated negative feedback significantly impair emotional regulation and decision-making under stress, a process well documented by the American Psychological Association, which explains how chronic stress increases threat perception and avoidance behavior. Internally, this dynamic connects directly with execution discipline and capital preservation principles discussed in our trading psychology resources, where protecting mental clarity during prolonged underperformance is treated as a prerequisite for long-term consistency rather than a secondary skill.

Conclusion: Survival Comes Before Winning

Long losing periods do not test talent. They test stability.

Most traders fail here not because they lack skill, but because prolonged underperformance quietly erodes confidence, clarity, and self-trust.

This phase is not evidence of failure. It is evidence that you are participating long enough for variance to fully express itself.

Survival is not passive. It is deliberate restraint. Less reacting. Less forcing. Less identity fusion. Those who survive return with a depth of stability that cannot be taught—only earned.

Frequently Asked Questions

Why do long losing periods feel worse than short losing streaks?

Because prolonged uncertainty activates threat responses and emotional accumulation.

Is a long losing period a sign my strategy is broken?

Not necessarily. Even strong edges experience extended variance.

Should I stop trading during a long losing period?

Many professionals reduce exposure rather than stop entirely.

How do professionals preserve confidence during drawdowns?

By separating identity from results and focusing on behavior rather than outcomes.

Can long losing periods make traders better?

Yes—if survived correctly, they deepen emotional control and resilience.