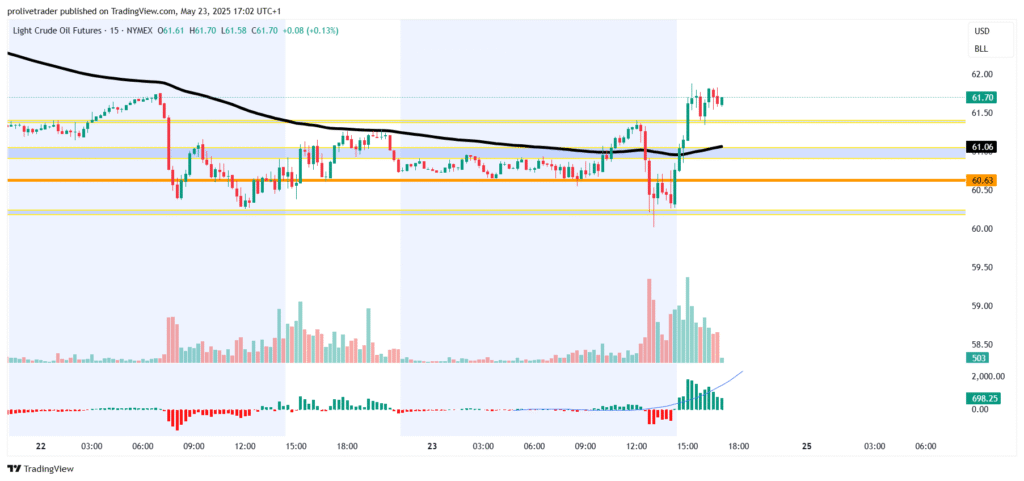

🛢️ CL (Crude Oil Futures) – Trade Recap | May 23, 2025

📍 Posted by Mastery Trader Academy – Precision meets purpose

🔥 Another clean day using the Mastery Trader Academy system — and once again, the market respected our pivots to the pip like absolute magic.

Today, Crude Oil delivered textbook reactions from every key zone we mapped out this morning. Price respected both our orange-line pivots and rectangle zones, offering beautiful opportunities to fade the highs, buy the dips, and trade the rejection structure like professionals.

✅ Why our system worked flawlessly today:

🔸 Our pivot zones aren’t random lines — they’re built using a deep understanding of structure, liquidity behavior, and volume exhaustion points. These are the areas where institutions make decisions — and we’re trading with them, not against them.

🔄 Price rejected our upper rectangle zone, confirming it as resistance early in the session. That was our signal to start watching for shorts. Not only did the move start from our marked supply zone — it retraced perfectly into the middle pivot where we saw volume shift, energy divergence, and clear absorption in the order book.

📉 From there, price dropped into our lower rectangle demand zone, where we anticipated a reaction or trap setup — and guess what? It held like a fortress. Buyers stepped in exactly where we expected, giving us clean confirmation to scale out of shorts or look for reversal setups.

🧠 Why we took trades at these pivots:

Each pivot was chosen because it represented a potential decision point in the market:

Upper zone → tested supply and imbalance — sellers defended it with strength.

Mid pivot → key structural support flipped from previous session — became resistance once broken.

Lower rectangle zone → untouched demand, prime location for a bounce once flow and volume confirmed.

We never enter blindly. We wait for confirmation from order flow, energy, and volume. Once all three align at our pivots — it’s game on.

📛 This isn’t luck. This is a system.

Day after day, the Mastery Trader Academy approach proves itself — not with hindsight, but with real-time planning, execution, and discipline. We don’t chase trades. We trade only where it matters, and we do it with confidence.

💡 Reminder: This is not financial advice. This is how we trade based on our system — a blend of experience, structure, and strategic patience.

— Mastery Trader Academy 🔥📈

Trading with clarity. Teaching with purpose.

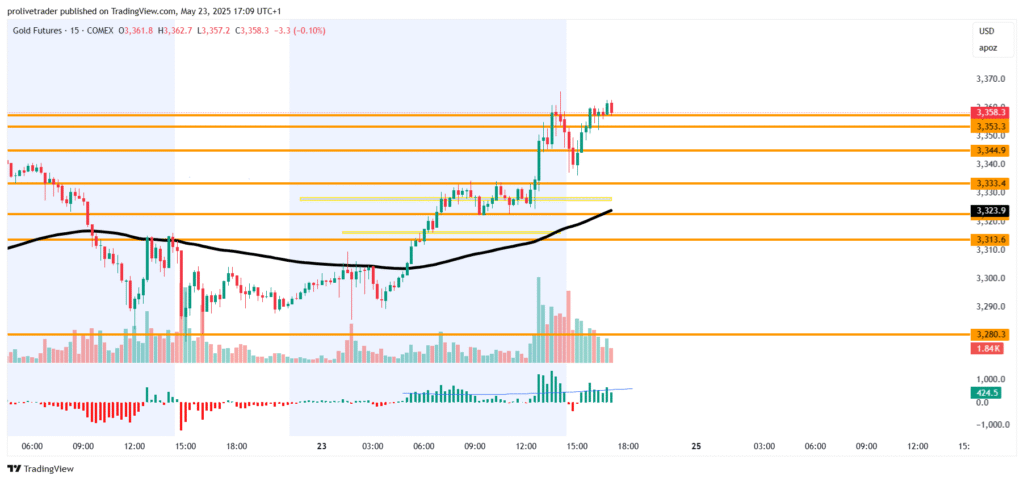

🟡 GC (Gold Futures) – Trade Recap | May 23, 2025

📍 Posted by Mastery Trader Academy – For educational purposes only

Today’s Gold session was a masterclass in structured execution — and the Mastery Trader Academy system once again delivered with surgical precision.

We didn’t just catch a good move — we executed a textbook breakout setup, scaled in with confidence, and closed exactly where price got capped.

🚀 Here’s how we traded it:

🔓 Breakout Entry

Price broke through our mapped mid-pivot zone with clean volume and energy confirmation. This was our signal. No hesitation. We entered the breakout — not on hope, but with confluence from structure, order flow, and momentum.

🔁 Pullback = Scale-In

When price pulled back to retest the breakout zone, we doubled the position. Why? Because everything aligned: buyers were still aggressive on the tape, volume was supportive, and energy was rising. We weren’t chasing — we were adding at strength.

🧱 Exit at Resistance

Our final take-profit was planned at the upper resistance pivot — and price respected it perfectly. It stalled, reacted, and that was our cue to close the trade in full. No overholding. No greed. Just pure execution.

📊 Why our pivots matter:

Every level on that chart today wasn’t just a guess — it was a decision zone. They marked where liquidity sits, where market makers trap participants, and where momentum either expands or collapses.

We acted only when:

🧾 Order flow confirmed strength and conviction

📈 Volume aligned with breakout behavior

⚡ Energy supported the continuation

This is the exact strategy we teach, and it works because it’s based on real market behavior, not predictions.

📛 This is how you master trading.

You don’t chase. You plan, wait, confirm, and execute. And when everything lines up, you go in with full conviction — just like we did today.

💡 This recap is for educational purposes only. Not financial advice. Always trade with discipline, structure, and a clear mind.

— Mastery Trader Academy 📈🔥

Precision. Structure. Confidence.

Understanding the psychological pitfalls in trading is crucial for long-term success. Our article on Why Most Traders Fail: The Psychology Behind Mistakes delves into common errors like fear-driven decisions and overtrading. For a broader perspective, Investopedia’s guide on Common Investor and Trader Blunders offers additional insights into avoiding these common traps.