Table of Contents

Introduction

Most traders don’t lose money because they chose the wrong strategy — they lose because they were given too much power too early. Leverage makes every mistake louder, faster, and more expensive, which is why so many promising traders disappear within their first year. One moment you feel in control, the next your account is gone, not because the market was unfair, but because exposure was misunderstood.

What makes leverage so dangerous is that it looks like opportunity while quietly removing your margin for error. Social media sells it as a shortcut to freedom. Brokers and prop firms present it as a tool for growth. But in reality, leverage is a pressure multiplier that turns small emotional slips into catastrophic losses. This is why traders who are technically skilled still fail — their exposure is misaligned with their psychology.

This guide is not here to scare you away from trading. It is here to give you the clarity most traders never get before they blow their first serious account. You will learn how leverage truly works behind the scenes, why most traders misuse it, and how professionals structure exposure so they can survive losing streaks, drawdowns, and volatility without self-destructing. If your goal is long-term consistency, funded accounts, or real capital growth, understanding leverage properly is not optional — it is survival.

Comparison Table

| Concept | What It Controls | Why It Matters |

|---|---|---|

| Account Size | Your total capital | Limits how much you can risk |

| Position Size | How much you risk per trade | Determines survival |

| Leverage | How much exposure you can control | Multiplies outcomes |

| Margin | Collateral required | Determines when liquidation occurs |

| Drawdown | How much you can lose | Ends accounts if breached |

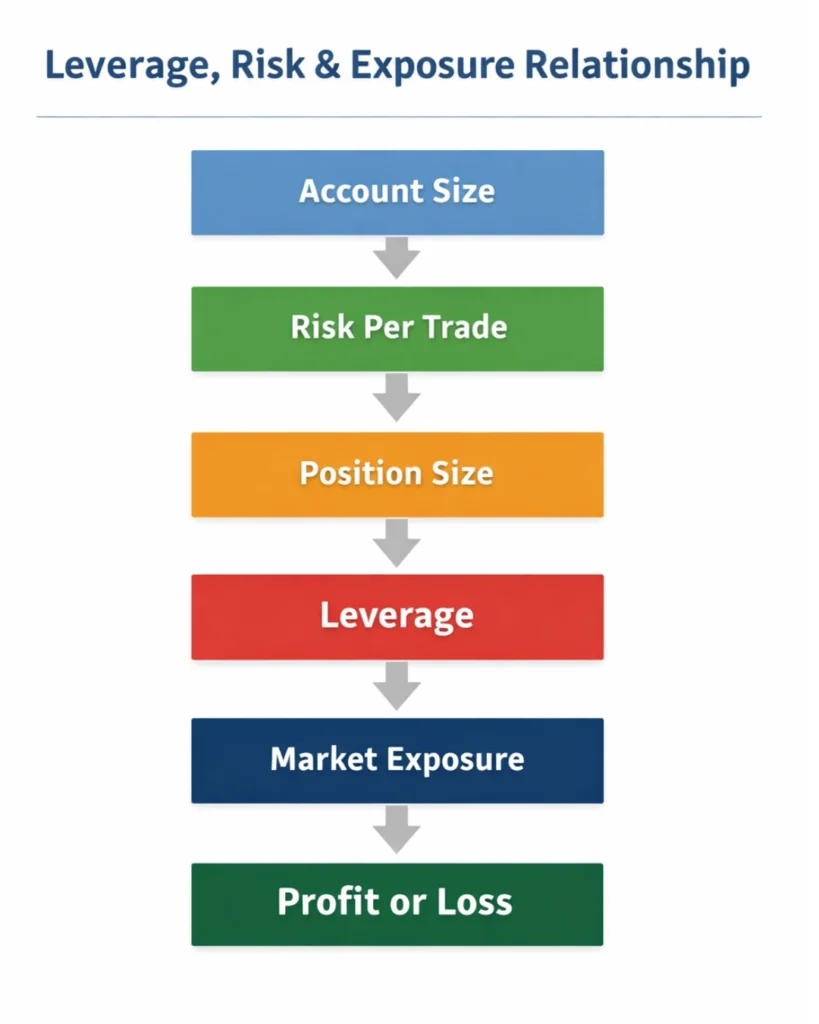

Leverage, Risk & Exposure Relationship

What Leverage Really Means in Trading

Borrowed capital is not free money. It is a financial mechanism that allows you to control more market exposure than your actual account balance would normally allow. When you open a trade using margin-based funding, you are not increasing your skill, accuracy, or edge — you are increasing how strongly price movements impact your account. This is why this type of exposure feels both powerful and dangerous at the same time. A small move in price becomes a large swing in equity, and this amplification is what makes high exposure so seductive to beginners.

Brokers and prop firms offer this buying power by requiring traders to deposit a small amount of capital, known as margin, in order to control a much larger position. The remainder of that position is effectively financed. If the trade moves in your favor, profits are calculated on the full exposure. If it moves against you, losses are also calculated on that same notional value. The market itself does not change — only your account’s sensitivity to price movement does. This is the fundamental truth most traders overlook when they first encounter margin-based trading.

Why Most Traders Blow Accounts With Leverage

Traders are drawn to leverage because it promises fast results. Many beginners start with limited capital and believe leverage is the solution that will allow them to “play the game” with bigger players. Unfortunately, this mindset creates the conditions for disaster. Leverage shortens the distance between a small mistake and a catastrophic loss. A single emotional trade, a late stop, or a misjudged pullback can destroy weeks of discipline in seconds.

The illusion of fast growth is especially dangerous. When a trader makes money with leverage, it reinforces the belief that bigger positions mean faster success. This quickly leads to oversizing, emotional attachment to trades, and ignoring drawdowns. Instead of learning to trade well, beginners learn to gamble with exposure.

Leverage vs Position Size (The Difference That Saves Traders)

One of the most important concepts in trading is that exposure and position size are not the same thing. Exposure determines how much of the market you control, while position size determines how much of your own capital is actually at risk. Professional traders use borrowed capital to allocate money efficiently, not to increase danger. Beginners, on the other hand, often use this buying power to trade larger than their experience allows.

If you risk 1% of your account per trade, your true risk does not change — as long as position size is calculated correctly. What destroys accounts is not the use of borrowed funds itself, but allowing that added buying power to create positions that are too large for both the account balance and the trader’s emotional tolerance.

How Borrowed Capital Works in Forex, Futures, and Crypto

Leverage behaves differently across markets. In forex, extremely high leverage is common, allowing traders to control large positions with very small deposits. This makes forex especially dangerous for beginners, because even small price moves can wipe out an account. Futures trading uses contract-based leverage with defined margin requirements, which makes risk more transparent but still unforgiving. Crypto trading combines extreme leverage with extreme volatility, creating the most dangerous environment for new traders.

The more volatile the market, the less leverage a trader should use. Volatility and leverage multiply each other.

The Psychology of Leverage

Leverage does not just affect your account — it affects your mind. When exposure is too high, every tick becomes emotionally charged. Traders begin to fear normal pullbacks, close winners too early, and hold losers too long. Instead of reading price, they watch profit and loss. This emotional pressure erodes discipline and turns trading into a stress-driven activity rather than a skill-based one.

Over time, high leverage trains the brain to associate trading with anxiety. This leads to burnout, impulsive decisions, and loss of confidence, even if the strategy itself is sound.

Why Overexposure Destroys Beginners Before They Ever Become Skilled

Most new traders do not fail because they lack intelligence, strategy, or motivation. They fail because they are given too much buying power before they have developed emotional control. Margin-based trading removes the natural learning curve that normally protects beginners from themselves. Small mistakes that would otherwise be harmless become financially devastating when exposure is too high. Instead of allowing traders to learn slowly, borrowed capital compresses the timeline — turning normal trial and error into account-ending events.

Modern markets only make this problem worse. Price moves faster than ever, news travels instantly, and volatility can spike without warning. When a trader is operating with amplified exposure, even routine market fluctuations can trigger margin calls, forced liquidations, or funded-account rule violations. What feels like an unpredictable market is often just misaligned exposure interacting with normal price movement.

Most beginners are not chasing risk — they are chasing relief. Limited capital, slow progress, and social-media success stories create the belief that trading bigger is the only way forward. Borrowed buying power looks like the solution, but it quietly removes the safety net that allows mistakes. The faster someone tries to grow, the less room they give themselves to be wrong — and being wrong is unavoidable in trading.

Once losses start to compound, the psychology shifts. A trader who loses 30 to 50 percent of their capital does not just lose money — they lose emotional stability. Fear increases, patience disappears, and decision-making becomes reactive. This leads to revenge trades, oversized positions, and a desperate attempt to “get it back,” which only accelerates the collapse. Excessive exposure does not just damage accounts — it damages confidence, discipline, and long-term decision-making.

This dynamic is even more dangerous inside funded trading programs. Prop firms provide large buying power but enforce strict drawdown rules. Many traders mistakenly treat this capital as disposable because it is not their own. In reality, funded environments are more unforgiving, not less. A few emotionally driven trades can violate daily loss limits or trailing drawdowns even when the strategy itself is profitable. The traders who succeed in these programs keep exposure small, respect risk limits, and focus on rule compliance rather than profit targets.

The most dangerous moment in a trader’s journey is not their first loss — it is their first win with amplified exposure. It creates the illusion that this approach works. In truth, it only proves that luck was favorable once. Real consistency is built through small, repeatable execution, not oversized bets. Traders who survive long term treat capital protection as their primary edge.

The purpose of trading in your first year is not to get rich — it is to stay in the game. Capital that survives allows skill to develop. Skill that develops allows profits to grow. Borrowed buying power should only increase after consistency exists, not before. Calm, controlled trading always outperforms exciting trading over time.

Why Leverage Destroys Consistency and Profits

Many traders blame leverage when their accounts collapse, but in reality the deeper problem is almost always a lack of emotional control and rule consistency. When exposure is high, every small mistake is amplified, which is why understanding the silent habits that destroy consistency becomes just as important as understanding the math of trading — something we break down in detail in Trading Consistency: The Silent Killers.

At the same time, learning how to protect open profits and avoid self-sabotage under pressure is what separates long-term survivors from short-term gamblers, which is why mastering the principles in Profit Protection and Trading Psychology is essential before increasing position size. This relationship between leverage, margin, and emotional decision-making is also well documented in professional finance education, including Investopedia’s clear breakdown of how leverage and margin actually work in real trading environments.

Buying Power Inside Prop Firms

Prop firms give traders access to large amounts of funded capital while enforcing strict drawdown rules. Many traders fail not because their strategies are flawed, but because amplified exposure combined with tight risk limits leaves no room for emotional mistakes. A few oversized trades can violate daily loss thresholds or trailing drawdowns, ending an account almost instantly.

Successful funded traders treat this buying power defensively. They keep position sizes small, protect capital, and focus on rule compliance rather than chasing profit targets.

The Most Common Leverage Mistakes Traders Make

• Using maximum leverage after a winning streak

• Increasing size to recover losses

• Trading high leverage during news

• Watching P&L instead of price

• Treating prop firm capital as disposable

These mistakes destroy more trading careers than bad analysis ever will.

How Professional Traders Use Leverage Safely

Professional traders think in terms of risk per trade, not exposure. They decide how much of their account they are willing to lose if the trade fails, then calculate position size accordingly. Leverage is simply a tool that allows them to control that position efficiently. It is never used to inflate risk.

Leverage Myths That Keep Traders Stuck

Many traders believe high leverage means higher profits. In reality, it means higher volatility in your equity curve. Another myth is that prop firms make leverage safe. They do not — they simply shift risk into drawdown rules.

A Note on Education and Risk

For a clear explanation of how leverage and margin work in financial markets, Investopedia’s leverage overview is a reliable reference. If you want to understand how psychology and discipline interact with leverage, our full trading psychology hub explores how emotional control protects capital over the long term.

FAQs About Trading Exposure

Is trading with borrowed capital bad?

No. What causes problems is misusing it through oversized positions and poor risk control.

Can beginners use margin-based trading?

Yes, as long as position size remains small and risk per trade is strictly controlled.

Does high exposure cause most account blowups?

It amplifies every mistake, which is why small errors become financially devastating.

Is crypto trading more dangerous with amplified exposure?

Yes. Extreme volatility combined with borrowed capital leads to frequent liquidations.

Can traders be profitable without using borrowed funds?

Absolutely. Many professional traders build consistency first before increasing their market exposure.

Final Thoughts — Why Leverage Is a Survival Tool, Not a Weapon

Leverage is not evil, but it is unforgiving. It does not reward excitement, ambition, or impatience. It rewards discipline, restraint, and respect for risk. Traders who survive long enough to become consistent do not chase leverage — they control it. They understand that the goal of trading is not to make the most money quickly, but to stay in the game long enough to let skill compound.

If you take one lesson from this guide, let it be this: your edge as a trader is not leverage. It is your ability to protect capital while you learn. When you master that, leverage becomes a tool — not a trap.