Table of Contents

Introduction

What’s ahead for crude oil (CL) and gold (GC) markets as key macro catalysts converge on 27 May — and how should traders position themselves before volatility spikes? With global energy dynamics shifting, inflation data looming, and central bank rhetoric influencing safe-havens, commodities like crude oil and gold have become focal points for both short-term traders and long-term investors. But navigating these markets without a clear framework can lead to hesitation, costly whipsaws, and missed opportunities. That’s why a data-driven, market-context-aware outlook is essential for traders in 2025.

Crude oil and gold don’t move in isolation; they are deeply connected to macroeconomic news, geopolitical shifts, demand expectations, and risk sentiment. Crude oil’s price action reflects supply fundamentals, inventory surprises, and energy demand forecasts, while gold often reacts to inflation expectations, real yields, and global risk flows. For traders, understanding these dynamics isn’t just about reading charts — it’s about interpreting where price is likely heading before major economic events hit the tape.

In this comprehensive 27 May market outlook, we’ll break down the latest technical setups, key support and resistance levels, and fundamental drivers shaping price behavior in both CL and GC. You’ll get a clear view of how trend structures, liquidity zones, and macro catalysts align — or conflict — and what those alignments mean for trade selection, risk management, and timing. Whether you trade futures, CFDs, or ETFs, this analysis arms you with actionable insights so you can approach the final week of May with confidence, not guesswork.

By the end of this outlook, you’ll understand not only what levels matter, but why they matter — and how to interpret collective market behavior in a way that helps you enter and manage trades with clarity. Let’s dive into the data, the charts, and the forces that are driving one of the most active commodity trading sessions of the month.

🧭 CL Current Market Outlook – May 27, 2025

CL Today, is trading just above the neutral structure zone, continuing its consolidation phase. Price remains between two well-defined support and resistance areas. The market appears to be compressing between the red supply zone above and the lower green demand zone, forming a structure that suggests a potential breakout or liquidity sweep setup.

The volume profile is evenly distributed, showing no strong institutional aggression at the time of writing.

🔑 Key Technical Zones

🔺 Red Zone: Strong resistance where price was rejected yesterday

🟩 Middle Green Zone: Neutral structure zone acting as both support and resistance recently

🟢 Bottom Green Zone: High-probability demand area where strong buyers stepped in last week

A descending channel breakout attempt occurred last session but failed to sustain above the upper blue trendline, keeping bears in partial control for now.

🔮 Trading Scenarios for Today

✅ Scenario 1: Pullback Buy from the Middle Zone

If price pulls back into the middle green zone, I will monitor for a bullish reaction — specifically a volume spike with a confirming candle (e.g. bullish engulfing). If confirmed, I’ll consider a long setup targeting the red resistance area above.

This setup aligns with continuation from neutral structure, provided order flow confirms the shift.

✅ Scenario 2: Rejection Short from the Red Zone

If price rises into the red resistance zone, I will wait to see how the market reacts. A failed breakout attempt with weak volume or seller-dominated candle structure could trigger a short opportunity, aiming for a move back toward the middle zone.

This zone has acted as a liquidity trap in recent sessions, so caution is essential. I only act if the reaction confirms intent.

✅ Scenario 3: Strong Buy from the Lower Green Zone

If price aggressively sells off into the lower green zone, I’ll treat this as a potential reversal area. This zone was the base for last week’s strong rally and has historically seen buyer interest. If we see a bullish rejection (especially on rising volume and delta shift), I’ll look to go long, targeting the middle zone.

This is my most aggressive long setup today and requires strong confirmation.

📊 Volume, Order Flow & Energy

Current session volume remains balanced

No major delta imbalances showing buyer or seller domination

Belkhayate Energie remains neutral — watching for a surge if price hits the lower zone

Price structure is overlapping — momentum needs a catalyst to break cleanly

🧠 Trader Insight

Today is a reactive trading day. Markets are awaiting stronger catalysts before choosing direction. Patience is key — the edges exist within structure, not in trying to forecast every tick.

I am personally standing by to respond to the market’s behavior, not its touch of a level. Each trade today will be based on real-time confirmation of intent.

📝 Summary

Price is stuck in mid-structure with compression forming

Three clear scenarios depending on which level price reacts to

All plans are confirmation-based, using volume + structure + order flow

I will remain flat unless the market clearly speaks

🛢️ CL Fundamental Outlook – May 27, 2025

🗓️ Macro Drivers Today

OPEC+ Production Speculation:

Rumors have resurfaced about potential discussions within OPEC+ to reassess production targets for Q3 2025.

Saudi Arabia and Russia are reportedly in early talks to address softer global demand, which could lead to production tightening.

If confirmed, this could create bullish pressure later in the week.

China’s Economic Data in Focus:

Fresh industrial production numbers from China showed a slight slowdown, reinforcing concerns over weak demand from the world’s second-largest oil consumer.

This may cap any significant rallies in crude unless countered by supply-side shocks.

US Economic Data Ahead:

Markets are anticipating U.S. crude oil inventory data (API today, EIA tomorrow).

Recent weeks have seen surprising builds in U.S. stockpiles, weighing on sentiment.

Additionally, consumer confidence and inflation sentiment data from the U.S. are due later today — if weaker, this could pressure oil through recessionary fears.

Geopolitical Tension Remains Muted:

No major geopolitical escalation is impacting supply routes this week so far.

Middle East remains relatively quiet, which keeps risk premium low for now.

🔙 What Happened Yesterday – May 26, 2025

CL attempted a breakout above the descending channel and briefly pierced the upper trendline, but failed to hold, closing back inside the compression structure.

Volume was light, likely due to the U.S. Memorial Day holiday — many institutions were off, and liquidity was thin.

Despite weak volume, bulls attempted to defend the $61.30–$61.50 support (middle green zone), showing the market is still respecting key technical zones.

The rejection from the red zone above ($62.00–$62.30 area) confirms it remains a strong supply ceiling.

🧠 Key Takeaway

Today’s trade will be shaped by market reaction to yesterday’s failed breakout, anticipation of U.S. inventory data, and headlines around OPEC+ negotiations. Unless any of these provide a directional catalyst, consolidation is likely to continue, with technical traders dominating flow until the next major data release or headline event.

🟡 Gold Futures Technical Outlook – May 27, 2025

Today, I am not trading Gold (GC) due to unclear structure and lack of clean directional momentum. Price action is currently unconvincing, and no high-probability setups are visible at this time.

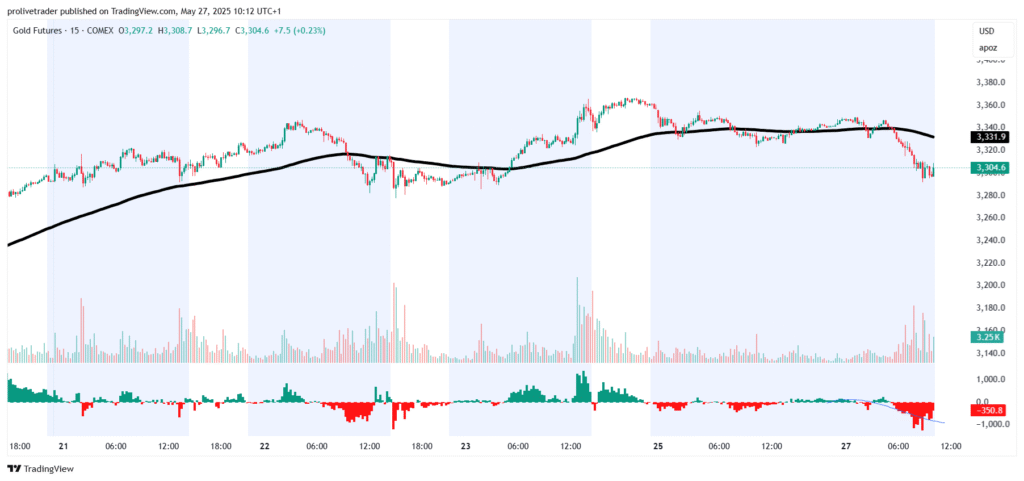

🔍 15-Minute Chart Overview:

GC is trading around $3,305 after a brief intraday bounce.

Price broke below the EMA, showing initial bearish pressure.

However, the bounce lacks volume commitment and appears reactive rather than impulsive.

Delta is still negative, suggesting sellers had control earlier — but recent price movement shows no fresh aggression from either side.

🕐 1-Hour Chart Overview:

A decisive candle closed below the EMA, typically a sign of weakness.

Yet, the current move lacks follow-through and volume remains balanced.

The broader structure is overlapping with no major breakout, breakdown, or liquidity sweep in sight.

Momentum indicators remain bearish but are beginning to flatten — signaling potential stalling, not strong continuation.

❌ Why I’m Sitting Out Today

Despite some technical signals hinting at weakness, there’s no strong setup or confirmation to justify taking a position. Here’s why I’m staying flat:

No reaction from a key support or resistance zone

No momentum surge or directional follow-through

Volume and structure are out of sync

Market is transitioning, not trending

This kind of environment often leads to choppy price action and fakeouts — not the conditions I want to trade in.

🧠 Trader Insight

Today is all about patience. Not every move deserves action. When structure is messy and conviction is low, preserving capital is a win. I’ll continue monitoring, but for now, GC stays on the watchlist — not in the trade queue.

🟡 Fundamental Outlook – Gold (GC) – May 27, 2025

🗓️ Macro Drivers Today

U.S. Dollar Stability After Memorial Day

With U.S. markets reopening after Monday’s holiday, the dollar index (DXY) opened relatively flat but remains elevated.

A stronger USD continues to pressure gold prices, reducing its appeal as a non-yielding asset.

Unless the dollar weakens or Treasury yields drop, gold will likely struggle to reclaim recent highs.

Global Inflation and Rate Expectations

Traders are pricing in no immediate rate cuts from the Fed, despite previous speculation. This is keeping gold under pressure.

European and UK inflation data later this week could move the needle slightly, but today is quiet on the economic calendar.

U.S. Consumer Confidence Due Later Today

The Conference Board Consumer Confidence Index is set to be released this afternoon.

A stronger-than-expected reading could boost risk assets and further weigh on gold.

Conversely, a weak print might support a short-term gold bounce, especially if recession fears return to the narrative.

No New Geopolitical Catalyst

As of this morning, there are no major global tensions or conflict escalations impacting safe-haven demand.

The geopolitical risk premium is currently minimal, which limits upside for gold unless something shifts.

🔙 What Happened Yesterday – May 26, 2025

Gold traded in low-volume conditions due to the U.S. Memorial Day holiday.

Price held below the key resistance structure around $3,340–$3,350, forming a lower high and confirming a shift in sentiment.

The lack of momentum left gold vulnerable to the downside, and today’s early-session weakness reflects that technical vulnerability.

There was no institutional-sized bid stepping in, and volumes remained thin — a clear sign that conviction was absent.

🧠 Key Takeaway

Gold enters today’s session under pressure after a technical break below key moving average support and amid macro calm. There are no major catalysts scheduled for this session beyond U.S. consumer confidence, so volatility could remain muted until tomorrow’s data picks up.

Unless the dollar weakens, yields drop, or risk-off sentiment re-emerges, gold is likely to remain in consolidation or drift lower as traders await a clearer macro or technical catalyst.

To strengthen your understanding of the key zones highlighted in today’s CL and GC outlook, we recommend this Investopedia guide on how to trade support and resistance — perfect for both beginners and advanced traders. For a deeper dive into structure, compression setups, and institutional price behavior, explore our in-depth Supply and Demand Strategy Guide.