Table of Contents

Introduction: Why Most Traders Get Red Days Completely Wrong

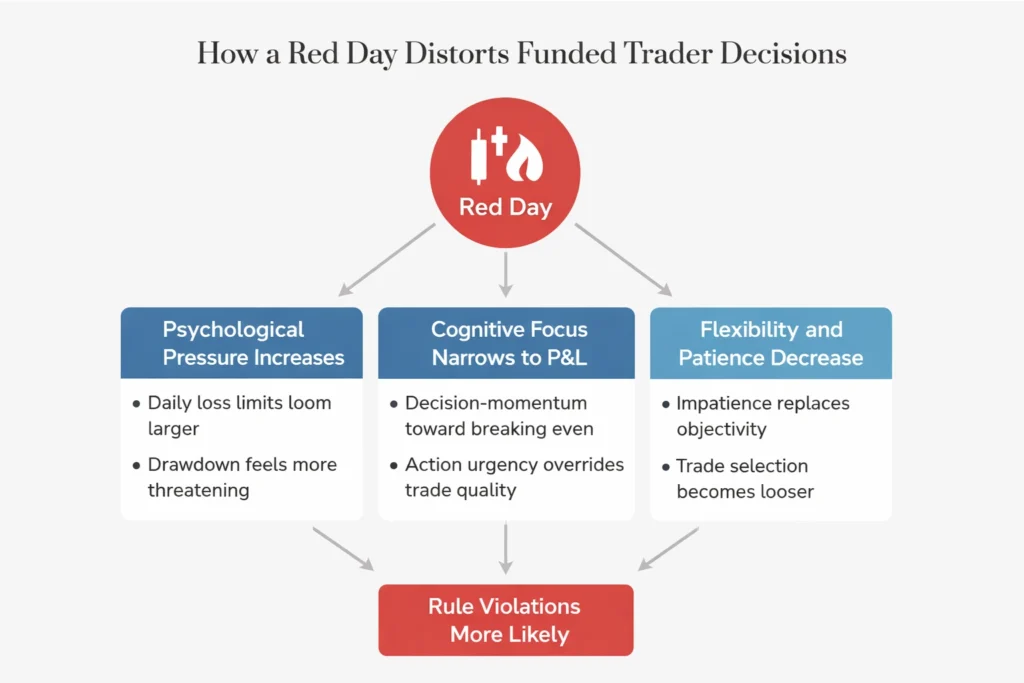

Most funded traders don’t lose their accounts during chaos, news spikes, or obvious rule-breaking. They lose them on ordinary days—days that start normally, feel manageable, and end slightly negative. A single red day doesn’t look dangerous on paper, yet it quietly becomes the most destabilizing moment in a funded trader’s career. The mistake most traders make is assuming the damage comes from the loss itself, when in reality it comes from how that loss reshapes decision-making afterward. This article explains why red days carry disproportionate psychological power in funded trading, how they subtly alter behavior, and why managing your response to loss matters far more than avoiding loss altogether.

If you have ever followed your rules, taken a reasonable loss, and still felt pressure building afterward—pressure to recover, pressure to prove competence, pressure to “fix” the day—this is not a personal flaw. It is a predictable psychological reaction that funded trading structures amplify. Understanding this dynamic is one of the most important survival skills a trader can develop.

Why a Red Day Feels More Dangerous Than It Actually Is

A red day does not simply reduce equity; it changes the internal reference point a trader uses to make decisions. Before the loss, trades are evaluated on quality, structure, and alignment with a plan. After the loss, the mind begins measuring every action against the desire to undo damage. The loss becomes the anchor, and all subsequent decisions orbit around it. This shift happens quietly, without emotional explosions or obvious panic, which is why it is so dangerous.

Funded accounts intensify this effect because losses do not exist in isolation. Daily loss limits and trailing drawdowns compress the trader’s sense of flexibility. Even when the numerical impact of a red day is small, the psychological weight feels larger because the trader knows future mistakes now carry greater consequences. What felt like normal variance before the loss now feels like a narrowing corridor.

This is why traders often report feeling “off” after a losing session even when they cannot point to any technical mistake. The discomfort is not about the trade—it is about the perceived loss of safety.

How Red Days Quietly Change Trader Behavior

The most destructive effect of a red day is not emotional distress but behavioral drift. Traders rarely respond to losing days by doing something obviously reckless. Instead, they make small, reasonable-sounding adjustments that collectively increase risk. Trade selection becomes slightly looser. Patience decreases. The desire to participate grows stronger, not because opportunity improved, but because inactivity now feels threatening.

This is where psychology takes control while pretending to be logic. The trader believes they are being careful, adaptive, or responsible, yet decisions are now influenced by outcome-focused thinking. The question is no longer “Is this a good trade?” but “Will this help?” In funded trading, that subtle shift is often enough to trigger rule violations over time.

The danger is not the loss itself. The danger is the new mindset the loss creates.

Why Recovery Thinking Is So Costly in Funded Accounts

Recovery thinking feels rational. After a red day begins to form, many traders tell themselves they are simply trying to reduce damage or return closer to breakeven. This intention feels disciplined, not emotional, which is why it bypasses internal warning signals. The trader is not trying to gamble; they are trying to restore balance.

Unfortunately, funded environments are designed in a way that punishes recovery behavior. When a trader starts trading the P&L instead of the market, setup quality degrades. Position sizing creeps upward. The willingness to stop decreases. Even when individual trades remain technically valid, the overall risk profile changes.

What makes recovery thinking especially dangerous is that it often works once. A small win reinforces the behavior and convinces the trader that pushing a little more is justified. This is usually where losses accelerate, not because the trader lost skill, but because emotional pressure replaced structural discipline.

A Note on Risk, Psychology, and Capital Protection

Understanding why a single losing session can escalate into account failure requires looking beyond charts and execution rules and into behavioral finance. Research on loss aversion and decision-making under pressure, such as the work summarized by the American Psychological Association on stress and cognitive bias, explains why traders behave differently once losses occur and why rational control deteriorates under emotional strain. This dynamic directly connects with the execution and risk-management principles discussed throughout our funded trading psychology resources, where controlling reactions to loss is treated as a core survival skill rather than a mindset issue.

How Daily Loss Limits Magnify Psychological Pressure

Daily loss limits exist to protect firms, but they also function as psychological amplifiers. Once part of the limit is used, every new decision carries additional weight. The trader becomes acutely aware that flexibility has been reduced, even if plenty of room remains numerically. This awareness compresses decision-making time and increases urgency.

Some traders respond by becoming overly cautious, skipping valid setups out of fear. Others do the opposite, pushing harder because they believe they must “use what’s left.” Both reactions originate from the same source: discomfort with uncertainty. The market has not changed, but the context has, and context matters more than most traders realize.

Professional funded traders treat daily loss limits as early warning systems, not targets. If the limit begins to matter emotionally, they step away long before it becomes a threat.

Why One Red Day Often Leads to Another

A common funded trading pattern is consecutive losing sessions that occur despite unchanged market conditions. This happens because emotional and cognitive carryover is real. After a red day, traders often start the next session with reduced confidence and heightened self-monitoring. Every trade feels like a test, and every fluctuation feels meaningful.

This internal pressure subtly degrades execution. Traders hesitate on valid entries, rush marginal ones, or adjust exits prematurely. These deviations rarely feel dramatic, which is why they go unnoticed in real time. The trader believes they are trading normally, yet behavior has shifted just enough to reduce expectancy.

In funded accounts, this effect is magnified by drawdown mechanics. A losing session does not reset emotionally overnight. It lingers, shaping decisions long after the loss itself has passed.

Common Mistakes Traders Make After a Red Day

One of the most frequent mistakes is refusing to stop early because stopping feels like failure. Many traders equate discipline with persistence, believing that continuing to trade under pressure proves resilience. In reality, continuing while emotionally compromised often increases the likelihood of rule violations.

Another mistake is over-analysis. Traders replay every decision, searching for errors that may not exist. This creates doubt and encourages unnecessary strategy changes. Over time, the trader loses trust not because the strategy is broken, but because confidence has been eroded by constant self-interrogation.

Perhaps the most damaging mistake is identity fusion. When a trader interprets a red day as evidence of personal inadequacy rather than variance, emotional pressure escalates rapidly. Trading becomes self-evaluation rather than execution, and objectivity disappears.

Why Most Traders Misunderstand Red Days

Most traders believe red days are dangerous because they reduce capital. This is only partially true. The real danger lies in how losses alter perception. Traders assume that feeling urgency after a loss is a signal to act, when in reality it is a signal to protect.

Another misunderstanding is believing that discipline alone is enough. Discipline helps traders follow rules in isolated situations, but prolonged psychological pressure requires stability, not force. Without emotional capacity, discipline becomes brittle and eventually collapses.

Finally, many traders assume professionals are unaffected by losing days. They are not. The difference is that professionals interpret losses correctly and reduce exposure rather than trying to prove competence under stress.

How Professional Traders Contain Red Days

Consistent funded traders do not try to “fix” red days. They contain them. Their response is structural, not emotional. After a losing session, they often reduce size, slow down trade frequency, and prioritize behavioral review over P&L review. The goal is not recovery; it is stability.

Professionals also redefine success during losing periods. Instead of measuring progress by profit, they measure it by execution quality, emotional regulation, and adherence to process. This reframing preserves confidence without requiring positive outcomes.

Most importantly, professionals do not allow a single red day to redefine identity. It is treated as expected variance, already accounted for in the risk plan.

How a Red Day Distorts Funded Trader Decisions

A Note on Risk, Psychology, and Capital Protection

Understanding how losing sessions influence behavior is central to professional trading psychology. Behavioral finance research shows that loss aversion and emotional ownership distort decision-making under uncertainty, a concept well documented by academic psychology sources such as the American Psychological Association’s research on cognitive bias and risk perception. Internally, this topic connects directly with execution discipline and capital preservation principles discussed throughout our trading psychology resources, where emotional neutrality is treated as a core risk-management skill rather than a personality trait.

What Actually Helps Traders Survive Funded Trading

Survival in funded trading is not about toughness. It is about reducing psychological load while maintaining structure. This means trading less during periods of stress, separating identity from outcomes, and allowing variance to resolve without interference.

Traders who survive long-term build identities that extend beyond daily results. They maintain routines outside trading, diversify sources of self-worth, and avoid over-exposure to performance metrics. This does not reduce ambition; it reduces existential pressure.

Acceptance without resignation is the mindset that carries traders through. Losses are acknowledged without being dramatized, and discomfort is allowed without being obeyed.

FAQ: Red Days in Funded Trading

Why does one red day feel so destabilizing?

Because it shifts the mental reference point from execution to recovery, increasing urgency and reducing objectivity.

Is a red day a sign that my strategy is failing?

Not necessarily. Even strong strategies experience variance. The key is whether execution remains intact.

Why do traders often break rules after a losing session?

Because emotional pressure accumulates, and traders attempt to relieve discomfort through action.

Should I stop trading after a red day?

Many professionals reduce exposure rather than stop entirely. The goal is psychological reset, not avoidance.

Can red days actually improve trading performance?

Yes, if handled correctly. They teach emotional regulation, patience, and structural discipline.

Conclusion: Red Days Don’t End Accounts—Reactions Do

A single red day does not destroy funded accounts. What destroys them is urgency, recovery thinking, and identity pressure that follow quietly afterward. Funded trading rewards traders who can accept imperfection without losing control. The skill that keeps accounts alive is not avoiding losses—it is managing responses to them.

If you can learn to treat a red day as a condition to manage rather than a problem to solve, you gain one of the most valuable advantages in funded trading: psychological survival.