Table of Contents

Introduction: When Losses Stop Feeling Like Data and Start Feeling Personal

Trading psychology is tested most brutally during long losing streaks, when discipline remains intact but confidence, identity, and emotional regulation begin to erode under prolonged drawdowns.

Most traders are prepared to lose money.

Very few are prepared to lose confidence slowly.

Long losing periods don’t arrive with drama or clear warning signs. There’s no single catastrophic trade, no obvious mistake to fix, no clean explanation that tells you what went wrong. Instead, losses accumulate quietly. Weeks pass. Then months. And at some point, trading stops feeling like a skill you’re developing and starts feeling like a test of who you are.

This is the phase where traders don’t rage-quit. They fade. Motivation weakens. Discipline feels forced. Every trade carries emotional weight. Even when rules are followed, doubt lingers. And the most dangerous thought appears: “Maybe this just isn’t for me.”

This article is not about improving entries or optimizing setups. It is about surviving long losing periods psychologically—without breaking your process, your identity, or your future as a trader. If you are in a prolonged drawdown and wondering how professionals endure these phases without self-destructing, this is the missing piece most trading education never teaches.

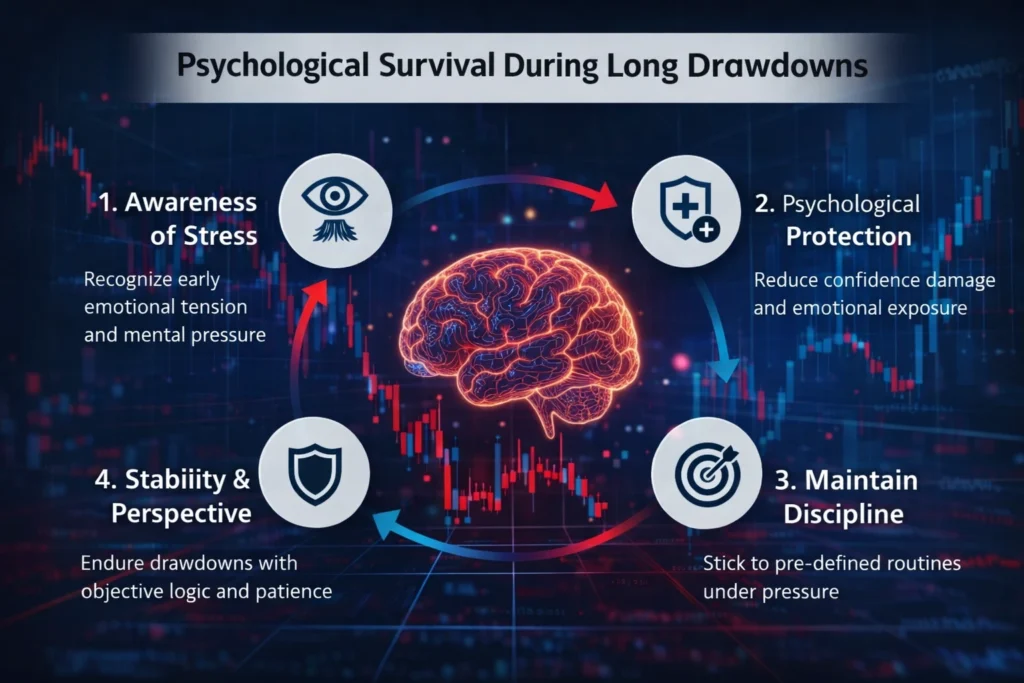

Long losing streaks are one of the most misunderstood challenges in trading psychology. While most traders focus on fixing strategies or finding better setups, professional trading psychology recognizes that prolonged drawdowns primarily damage confidence, decision quality, and emotional regulation. Understanding how trading psychology reacts under extended pressure is essential for surviving periods where results disappear but discipline must remain intact.

Why Long Losing Periods Feel So Much Worse Than Normal Losses

Every trader expects losses. That expectation collapses when losses refuse to resolve.

Short losing streaks hurt, but they still feel temporary. Long losing periods feel existential. They distort perception, compress patience, and quietly change how traders interpret information. Over time, losses stop being viewed as statistical variance and start being experienced as personal failure.

This shift matters because the brain does not process prolonged uncertainty rationally. Without positive feedback, the mind searches for meaning, and when meaning isn’t obvious, it turns inward. Traders begin questioning their competence, their past success, and their future potential—not because those things have objectively changed, but because extended drawdowns erode psychological safety.

What makes this phase especially dangerous is that nothing appears “broken” enough to justify stopping, yet nothing improves enough to restore confidence. The trader exists in limbo—still active, still trying, but increasingly unstable.

The Role of Trading Psychology During Extended Losing Streaks

Extended losing streaks expose the deepest weaknesses in trading psychology. When losses persist, trading psychology shifts from rational analysis to emotional defense, often without the trader noticing. Fear, urgency, and self-doubt slowly override execution discipline, causing traders to abandon otherwise sound processes. Professional trading psychology does not attempt to eliminate these reactions; instead, it teaches traders how to recognize emotional stress early, reduce psychological exposure, and maintain behavioral stability until variance resolves.

The Silent Psychological Damage of Extended Drawdowns

Long losing periods don’t collapse confidence all at once. They wear it down incrementally.

Each losing week adds friction. Each quiet session drains belief. Each comparison with other traders amplifies self-doubt. Eventually, even correct decisions feel pointless. Execution becomes heavier. Patience thins. Emotional reactions intensify.

The most destructive outcome isn’t financial loss—it’s loss of clarity. When clarity disappears, traders stop trusting their own judgment. And when self-trust erodes, decision-making becomes defensive. Traders aren’t managing risk anymore; they’re managing discomfort.

This is why long losing periods break traders who are otherwise disciplined and intelligent. The damage happens beneath the surface, long before behavior visibly collapses.

Why Most Traders Quit During This Phase

Contrary to popular belief, most traders don’t quit after blowing up accounts. They quit during prolonged underperformance.

This phase is uniquely exhausting because it offers no emotional resolution. The pain isn’t intense enough to force decisive change, but it’s persistent enough to make continuing feel unbearable. Motivation fades. Discipline turns into effort. Strategy hopping starts to feel logical—not reckless, but necessary.

The human mind is not designed to tolerate uncertainty indefinitely without relief. When relief doesn’t arrive through results, traders unconsciously seek it through action—adjusting, forcing, abandoning, or disengaging entirely.

What This Article Will Actually Help You Do

This article will not promise recovery timelines or motivational shortcuts. Instead, it will help you understand:

- Why long losing periods trigger identity-level stress

- The psychological traps traders fall into during extended drawdowns

- Why discipline alone is insufficient for survival

- How professional traders interpret and manage prolonged underperformance

- What actually stabilizes traders long enough for variance to resolve

Surviving this phase is not about optimism. It is about psychological stability. Because long losing periods are not a test of intelligence or effort—they are a test of endurance.

Trading Psychology Is the Core Skill During Drawdowns

Trading psychology becomes the dominant performance factor during extended losing streaks because technical knowledge alone cannot regulate emotional pressure. When outcomes stop reinforcing behavior, trading psychology determines whether a trader maintains execution discipline or begins reacting defensively. Strong trading psychology allows traders to recognize emotional fatigue, reduce psychological exposure, and avoid decision-making driven by fear or urgency. Without stable trading psychology, even sound strategies deteriorate under prolonged stress, leading traders to abandon rules, overcorrect systems, or disengage entirely. This is why professional trading psychology focuses less on motivation and more on emotional containment during uncertainty.

Why the Brain Treats Drawdowns as Threats

Extended losing periods activate the brain’s threat systems. This is not metaphorical—it’s biological.

When losses persist, the brain shifts away from analytical reasoning and into survival mode. In this state, risk feels amplified, time feels compressed, and uncertainty becomes intolerable. The trader may believe they are thinking logically, but internally, the nervous system is scanning for escape.

This explains why, during long drawdowns, small losses feel disproportionately painful and normal variance feels catastrophic. The brain is no longer asking whether a trade is valid. It’s asking how to make the discomfort stop.

Over time, emotional accumulation occurs. Each new loss reactivates previous frustration, strengthening a narrative of failure. By the twentieth loss, the trader is no longer reacting to the current trade—they are reacting to the entire history of the drawdown.

The Identity Threat Hidden Inside Long Losing Periods

Extended drawdowns quietly attack identity.

Traders begin questioning whether past success was luck, whether they truly belong in the market, and whether continuing is a waste of time. These thoughts are rarely voiced, but they influence behavior profoundly. Once identity feels threatened, objectivity collapses. Decision-making becomes defensive. The need to prove competence intensifies.

At this stage, trading stops being about execution and becomes about self-validation. This is where otherwise solid traders begin sabotaging themselves without realizing it.

Common Psychological Traps During Prolonged Losing Periods

Personalizing the Drawdown

Losses stop being viewed as system behavior and start being interpreted as personal inadequacy. The internal language shifts from “this strategy is underperforming” to “I am underperforming.” Once this happens, emotional weight increases and neutrality disappears.

Overcorrection and Constant Adjustment

Stillness becomes unbearable, so traders tweak rules, change sizing, switch markets, and add complexity. Each change feels justified. In reality, constant adjustment prevents resolution and creates noise instead of clarity.

Abandoning Strategies at the Worst Moment

Many traders quit strategies just before variance turns. Not because the edge disappeared, but because the psychological cost became too high. This creates a cycle of enduring pain, quitting early, missing recovery, and starting over elsewhere.

Fear-Based “Discipline”

Traders convince themselves they are being disciplined by trading smaller, exiting early, or avoiding valid setups. In reality, they are managing emotion, not risk. Fear replaces structure.

Quiet Withdrawal

Some traders don’t overtrade—they disengage. Journaling stops. Reflection fades. Interest declines. This calm exterior hides internal collapse.

Why Discipline Alone Cannot Carry You Through This Phase

Discipline is a finite resource. It works well in short bursts, but long losing periods ask it to do something it wasn’t designed for: sustain motivation without reward.

Each disciplined action taken while losing costs more energy than the last. Eventually, discipline doesn’t vanish—it exhausts. When traders respond by forcing themselves harder, pressure increases and stability collapses.

Professionals understand this difference. Discipline controls behavior. Stability preserves capacity. During long losing periods, capacity matters more.

How Professional Traders Think During Prolonged Underperformance

Professionals do not interpret drawdowns as personal failure. They expect variance to feel uncomfortable. They separate identity from outcomes and focus on exposure management rather than recovery.

Instead of asking how to win back losses, they ask how to remain intact. This often means trading less, shortening sessions, reducing emotional exposure, and protecting mental capital. This is not avoidance—it is risk management applied to the trader.

Psychological Survival During Long Drawdowns

What Actually Helps Traders Survive Long Losing Periods

Survival does not come from toughness. It comes from protection.

Professionals shrink emotional surface area by trading less frequently, checking results less often, and limiting exposure to noise. They redefine success behaviorally rather than financially and allow doubt to exist without acting on it.

They also protect identity outside trading. When trading is not the sole source of self-worth, drawdowns lose their existential power.

A Note on Risk, Psychology, and Capital Protection

Understanding how prolonged emotional stress affects decision quality is a cornerstone of professional trading psychology. Research in behavioral finance consistently shows that sustained uncertainty degrades judgment and increases impulsive behavior over time. A neutral, well-documented explanation of how emotional regulation interacts with financial decision-making can be found in Investopedia’s behavioral finance resources, which provide a solid external reference for this concept. Internally, this psychological dynamic connects directly with execution discipline and capital preservation frameworks discussed in Profit Protection and Trading Psychology and Trading Consistency: The Silent Killers, where emotional control is treated as a core risk management tool rather than a personality trait.

Frequently Asked Questions

Why do long losing periods feel worse than short losing streaks?

Because prolonged underperformance activates threat responses in the brain. Over time, losses stop feeling informational and begin to feel personal, which amplifies emotional stress.

Does a long losing period mean my strategy is broken?

Not necessarily. Even strong strategies experience extended drawdowns due to variance. Execution quality matters more than short-term results.

Should I stop trading during a long drawdown?

Not always. Many professionals reduce exposure rather than stop completely, preserving clarity while staying aligned with the process.

Why do traders make their worst decisions during drawdowns?

Because emotional pressure accumulates, leading to overcorrection, fear-based decisions, and premature strategy abandonment.

Can surviving long losing periods actually improve a trader?

Yes—if handled correctly. Traders who survive these phases often develop superior emotional regulation, patience, and long-term stability.

Conclusion: Survival Comes Before Winning

Long losing periods are not a verdict on your ability. They are a consequence of participating in a probabilistic environment long enough for variance to fully express itself.

Most traders never reach this phase because they quit early. Those who do often mistake frustration for failure. But mastery does not announce itself with momentum. It arrives quietly—disguised as doubt, boredom, and discomfort.

The traders who survive do not fight harder. They protect themselves long enough for time and probability to work. And when recovery finally comes, it arrives on top of a level of psychological stability that cannot be taught—only earned.

If you are in this phase now, this is not the moment to prove anything.

It is the moment to preserve what matters most: clarity, identity, and the ability to continue.

This is why trading psychology is not about motivation or confidence tricks, but about surviving uncertainty long enough for probability to reassert itself.