Table of Contents

Introduction: The Uncomfortable Truth Most Traders Avoid

Most traders don’t fail because they lack intelligence, effort, or market knowledge. They fail because they cannot stay emotionally aligned with a process that feels unrewarding in the short term. When trading finally becomes stable—fewer trades, fewer mistakes, smaller swings—it often triggers doubt instead of confidence. The silence feels suspicious. The calm feels undeserved. And the absence of excitement makes many traders wonder whether they are actually progressing at all.

This reaction is not irrational. It is psychological. Trading consistency does not stimulate the brain the way wins, volatility, and constant action do. It removes drama, urgency, and emotional payoff—exactly the elements the brain has learned to associate with progress. As a result, traders often sabotage their best phase of development without realizing it.

This article explains why consistency feels boring, why boredom is often misinterpreted as failure, and why professional traders deliberately design their execution to feel uneventful. More importantly, you will learn how to recognize when boredom is a warning sign—and when it is proof that your process is finally working.

Why Most Traders Get Consistency Completely Wrong

Most traders believe consistency is something you arrive at after success. They assume it comes later — once confidence is high, once profits are large, once experience accumulates. This belief quietly sabotages progress because it frames consistency as a reward instead of a requirement.

In reality, consistency is not the result of trading well. It is the condition that makes trading well possible in the first place. Beginners and intermediate traders often chase improvement through new strategies, new markets, or more screen time, without realizing that inconsistency is the root problem holding everything back.

Another reason consistency is misunderstood is because it does not provide immediate feedback. A dramatic win feels validating. A calm session with no emotional reaction feels empty. The brain naturally assigns more value to what feels intense, even when that intensity is destructive. As a result, traders confuse stimulation with effectiveness and assume that if trading feels dull, something must be missing.

Professional traders learn this lesson the hard way: consistency feels wrong because it removes emotional signals the brain has learned to trust. Until that misunderstanding is corrected, traders will continue to abandon stable behavior in favor of exciting but unreliable outcomes.

Key clarification:

Consistency is not the absence of ambition. It is ambition expressed through restraint.

Why Trading Consistency Feels Unnatural at First

Trading consistency often feels uncomfortable precisely because it removes emotional stimulation from decision-making. When traders first begin to act consistently, the experience rarely feels rewarding in the short term. There are fewer trades, less excitement, and fewer emotional highs to reinforce behavior. This is why many traders abandon trading consistency just as it begins to protect them.

What most traders don’t realize is that trading consistency is not designed to feel good — it is designed to reduce error. Consistent trading behavior limits overexposure, prevents emotional escalation, and removes unnecessary decisions. While excitement provides stimulation, trading consistency provides stability, which is what allows performance to compound over time.

Professional traders understand that trading consistency is a structural advantage, not a motivational state. They do not rely on excitement to execute. Instead, they build routines where trading consistency becomes automatic, predictable, and emotionally neutral. This is why consistency often feels boring before it feels powerful.

Why Most Traders Misunderstand What Consistency Looks Like

One of the biggest misconceptions in trading is that improvement should feel obvious. Traders expect growth to be accompanied by stronger emotions, clearer signals, or more confidence. In reality, the opposite is true. As execution improves, emotional intensity decreases. As decision quality improves, urgency fades. As discipline stabilizes, the trading day becomes quieter.

This creates a dangerous mismatch between expectation and reality. Traders believe that if something is working, it should feel rewarding. But consistency rarely feels rewarding in the moment. It feels repetitive. It feels restrained. And it often feels boring.

Professional traders understand that consistency is not a feeling—it is a pattern of behavior. Beginners and intermediates, on the other hand, often judge progress by how engaged or stimulated they feel. That difference alone explains why so many traders abandon a working process prematurely.

The Psychological Cost of Excitement in Trading

Excitement is not neutral. It is a heightened emotional state that alters perception, risk assessment, and decision speed. When traders feel excited, they interpret information differently. Risk appears smaller. Opportunity appears closer. Confidence increases without additional evidence. These effects feel positive, but they are unstable.

Markets reward patience, selectivity, and emotional neutrality—not heightened arousal. The trader who feels “in the zone” is often operating closer to emotional bias than clarity. This is why many traders perform best on days when they feel almost underwhelmed by the market. Emotional flatness allows the mind to observe without interference.

Excitement also creates dependency. Traders begin to associate performance with stimulation, which makes calm sessions feel unproductive—even when execution quality is high. Over time, this leads to subtle behavioral drift: more trades, looser filters, extended sessions, and unnecessary risk.

Why Boredom Feels Like Failure (But Isn’t)

Boredom is one of the most misunderstood signals in trading. For many traders, boredom triggers anxiety because it resembles stagnation. The mind equates action with progress, and stillness with wasted potential. When trading becomes repetitive and emotionally neutral, the brain often responds with doubt.

This response is biological, not logical. The brain is wired to seek novelty and stimulation. Trading consistency removes both. As a result, boredom can feel like regression—even when metrics are improving. Traders may think they are “losing momentum” when in fact they are stabilizing.

Professionals interpret boredom differently. To them, boredom indicates that the system is operating within expected parameters. Risk is controlled. Conditions are respected. Emotional noise is low. Boredom is not a lack of opportunity—it is the absence of unnecessary decisions.

Common Mistakes Traders Make When Trading Feels Too Calm

When traders encounter boredom, they often respond by trying to fix it—without realizing that boredom itself is not the problem. The most common mistakes include increasing trade frequency, expanding markets prematurely, adding complexity to a working system, or extending sessions beyond planned limits.

These actions are rarely driven by logic. They are driven by discomfort with stillness. Traders mistake emotional neutrality for disengagement and attempt to reintroduce stimulation. Ironically, these changes often reintroduce the very volatility and inconsistency they were trying to escape.

Consistency does not collapse suddenly. It erodes quietly through small, justified deviations. Each deviation feels reasonable in isolation. Over time, the cumulative effect dismantles what was working.

Why Professionals Design Trading to Be Boring on Purpose

Professional traders do not tolerate boredom—they engineer it. They deliberately remove elements that create emotional spikes, such as excessive screen time, constant monitoring, and discretionary overrides. Their goal is not excitement, but predictability.

Predictable processes reduce decision fatigue. Reduced fatigue preserves judgment. Preserved judgment enables consistency. This chain is intentional. Professionals understand that emotional highs—especially positive ones—are expensive. They lead to overconfidence, boundary erosion, and longer sessions.

By limiting decisions and enforcing structure, professionals protect their mental capital. They do not rely on motivation or discipline alone. They rely on systems that assume human limitations and compensate for them.

How to Measure Progress When Trading Feels Uneventful

One of the most difficult transitions in trading is learning how to recognize progress when it no longer feels dramatic. At this stage, traditional markers such as excitement, intensity, or frequent wins become unreliable. Progress shows up elsewhere.

Professionals look for shrinking emotional swings, fewer impulsive trades, faster recovery after losses, and consistent adherence to session limits. They evaluate behavior more than outcomes. A day with no trades but perfect discipline is considered successful. A profitable day with emotional deviation is not.

This reframing is essential. Consistency compounds quietly. It does not announce itself. Traders who wait for excitement as proof of progress often miss the most important phase of development.

Boring Consistency vs Exciting Trading: What Actually Performs Better

To understand why boring consistency wins long term, it helps to compare it directly with the type of trading most people find attractive in the early stages.

| Aspect | Exciting Trading | Boring Consistency |

|---|---|---|

| Emotional State | High arousal, anticipation | Calm, emotionally neutral |

| Trade Frequency | High | Selective |

| Decision Quality | Reactive, fast | Deliberate, repeatable |

| Risk Exposure | Variable, often inflated | Controlled and predictable |

| Session Length | Extended, fatigue-driven | Defined and contained |

| Short-Term Feel | Engaging, stimulating | Uneventful, restrained |

| Long-Term Result | Burnout, inconsistency | Stability, compounding |

This contrast reveals a truth most traders resist: what feels good in the moment rarely performs well over time. Exciting trading satisfies emotional needs. Boring consistency protects capital, clarity, and longevity.

Professionals are not immune to temptation. They simply structure their environment so temptation has fewer opportunities to interfere. Over time, this difference compounds into a massive performance gap.

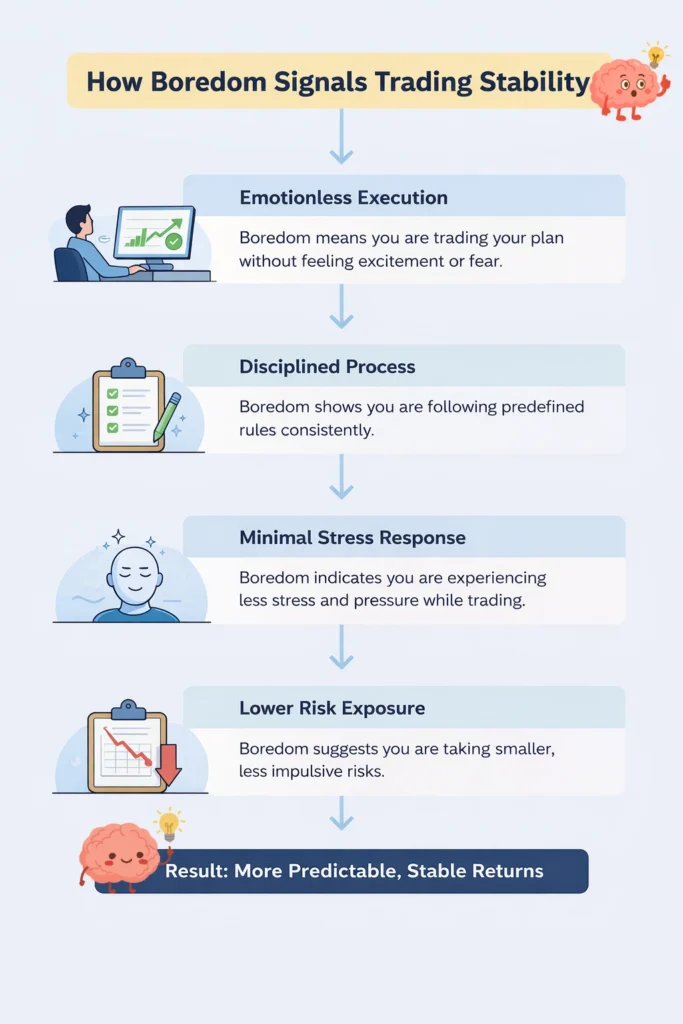

👉 How Boredom Signals Trading Stability

A Note on Risk, Psychology, and Capital Protection

Understanding the relationship between emotional arousal, mental fatigue, and decision quality is a cornerstone of professional trading psychology. Research in behavioral finance consistently shows that heightened emotional states impair judgment under uncertainty, leading traders to deviate from their plans even when they are technically sound. A neutral explanation of how emotions influence financial decision-making can be found in Investopedia’s overview of behavioral finance, which provides a clear external reference for how psychology interacts with risk in real trading environments.

Internally, this concept connects directly with execution discipline and capital preservation frameworks discussed in Profit Protection and Trading Psychology, as well as the risk exposure mistakes outlined in Leverage: 7 Brutal Mistakes That Wipe Out Traders (2026), where emotional control is treated as a practical risk management skill rather than a personality trait.

Why Most Traders Eventually Drift Away From Consistency

Few traders consciously reject consistency. Most drift away from it slowly. At first, calm trading feels refreshing. Losses shrink. Emotional damage reduces. Over time, however, restlessness appears. The brain begins to crave stimulation again.

Traders romanticize past intensity and forget its cost. They remember big wins, not the drawdowns. Chaos starts to feel attractive. The ego looks for re-entry points. This is not failure—it is dopamine withdrawal.

Those who last learn to value durability over stimulation. They accept that boredom is not an obstacle to overcome, but a state to normalize.

Frequently Asked Questions (FAQ)

Why does trading consistency feel boring?

Because consistency removes emotional stimulation. It reduces novelty, urgency, and dramatic outcomes, which the brain often associates with progress—even when those elements are harmful.

Is boredom a bad sign in trading?

No. Boredom often indicates that risk is controlled, rules are being followed, and emotional reactivity is low. Many professionals view boredom as confirmation of stability.

Why do traders sabotage consistency once it starts working?

Because consistency starves the brain of dopamine. Without awareness, traders seek stimulation through more trades, higher risk, or unnecessary complexity.

How do professional traders handle boredom?

They expect it. Professionals design trading systems to be repetitive and emotionally neutral. They measure success through discipline and longevity, not excitement.

How can I tell if I’m progressing when trading feels uneventful?

Progress shows up as fewer mistakes, smoother equity curves, faster emotional recovery, and consistent adherence to limits—even when sessions feel quiet.

Why Trading Consistency Feels Wrong but Protects Performance

Trading consistency often feels wrong because it contradicts how progress feels in most other areas of life. In trading, consistent behavior reduces stimulation, compresses emotional range, and limits visible action — all of which the brain misinterprets as stagnation. This is why many traders abandon trading consistency right when it starts protecting them from unnecessary risk.

What traders eventually learn is that trading consistency is not designed to feel rewarding. It is designed to be survivable. It minimizes exposure to emotional swings, preserves decision quality across sessions, and creates a stable foundation where skill can actually compound. Once this reframing clicks, boredom stops feeling like a warning sign and starts feeling like confirmation.

Consistency does not make trading exciting. It makes it durable. And durability is the difference between short-lived success and long-term participation in the market.

Conclusion: Boring Is the Sound of Stability

Trading consistency does not feel powerful. It feels quiet. It lacks drama, urgency, and emotional payoff. And that silence is precisely what makes it sustainable. When trading becomes boring, losses shrink, mistakes decline, and confidence stabilizes—not because of excitement, but because of control.

The traders who last are not the most intense. They are the most regulated. They do not chase stimulation or confuse excitement with progress. They show up, execute, stop, and repeat. Over time, boring behavior compounds into extraordinary results.

If your trading feels calm, repetitive, and emotionally flat, you are not stuck. You are likely closer to consistency than you think. Consistency does not feel like success when it arrives. It feels like maintenance. And maintenance is what keeps you in the game.